Closing a Limited Company with Debts?

Anderson Brookes Insolvency Practitioners help directors close limited companies with debt quickly, legally and with expert guidance every step of the way.

Understand Your Options Today

How to Close a Company with Debts - Director Support & Guidance

If your company is struggling with debt and you’re considering closing it, you’re not alone. Thousands of directors each year face the same dilemma. At Anderson Brookes, we understand how difficult this decision can be and we’re here to offer honest, regulated advice that protects your interests and keeps you compliant with the law.

Can you liquidate your limited company?

Closing a Company in Debt: What Are the Options?

When a company can no longer pay its bills as they fall due, or its liabilities outweigh its assets, it is considered insolvent. At this stage, you cannot simply strike the company off the register. Instead, a formal insolvency procedure is required.

Compulsory Liquidation

This is where a creditor forces the company into liquidation through the courts. It is often more stressful and can carry more reputational and legal risk. We help directors take control of the situation before it gets to this point.

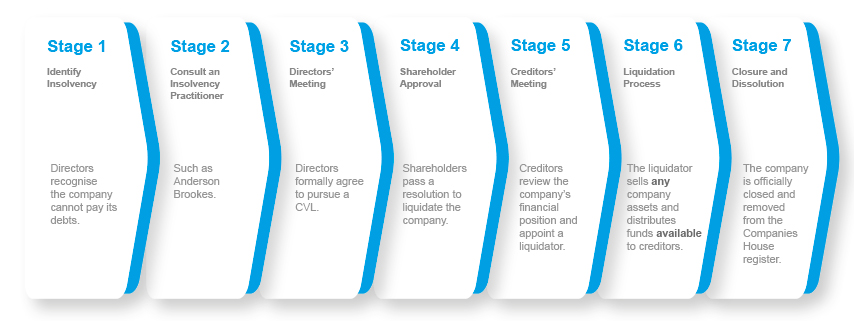

Creditors’ Voluntary Liquidation (CVL)

This is the most common route for directors looking to close a company with debt. It’s a formal process led by a licensed insolvency practitioner, where the business is wound up and any assets are used to repay creditors. Directors remain in control until the liquidator is appointed and, when handled properly, this route offers legal protection from further creditor action.

We can place a company into liquidation within 8 days!

Low cost and practical solutions for company directors who need to close their limited companies with debts.

Why Directors Choose Anderson Brookes

With more than 25 years’ experience and thousands of directors helped, we’re trusted by business owners across the UK. You can speak directly with an expert insolvency practitioner and we’ll help you understand your options clearly and quickly. We specialise in working with small and medium businesses and we understand your perspective and priorities.

Ready to

Move On?

If you’re ready to close your company, stop creditor pressure, or just want to understand your next steps, we’re here to talk.

Call us now on 0800 1804 935 or request a call back - we’re here to help.

Director Responsibilities During Closure

If your company is insolvent, your legal duty shifts from protecting shareholders to protecting creditors. You must:

Stop trading immediately to prevent additional losses

Not move or hide company assets

Avoid paying one creditor in preference over others

Keep all financial records safe and accurate

Seek advice from a licensed insolvency practitioner as soon as possible

Failing to meet these duties can result in serious consequences including disqualification or personal liability for company debts.

“From the first call I received from Anderson Brookes I was very impressed with how friendly and professional they were. I agreed to take them on to liquidate my company and very pleased with my decision. All done and dusted in very quick order.” Lynne Bull

Lots more testimonials below.

What If the Company Has No Assets?

You can still close an insolvent company through CVL even if there are no assets to sell. In many cases, directors can personally fund the low-cost process or may be eligible to claim director redundancy to help cover the costs. We’ll talk you through all your options.

Support from a Licensed Insolvency Practitioner

Only a licensed insolvency practitioner can lead a liquidation. At Anderson Brookes, our in-house team works directly with company directors to explain every step and manage the entire process. No pushy sales, no third-party handovers. Just honest advice and regulated support.

Take the First Step

If you’re worried about your company’s debts, the best thing you can do is speak to someone. We offer free, confidential advice to help you understand your options and move forward.

Email: advice@andersonbrookes.co.uk

Call Free: 0800 1804 935

Take action early and get the right advice from licensed experts who understand exactly what you’re going through.