Company Insolvency Practitioners: Essential Experts for Business Recovery

Who Are Company Insolvency Practitioners?

Company insolvency practitioners are licensed professionals who manage the affairs of insolvent businesses. They play a crucial role in guiding companies through financial distress and ensuring fair outcomes for creditors.

Understanding Their Role in Insolvency Cases

Insolvency practitioners assess a company’s financial position and recommend appropriate courses of action. They may attempt to rescue the business through restructuring or negotiate with creditors to reach agreeable terms. If rescue isn’t feasible, they oversee the orderly winding up of the company.

These professionals have the authority to take control of the company’s assets and affairs. They investigate the causes of insolvency and the conduct of directors. Their duties include selling assets, collecting debts, and distributing funds to creditors.

Insolvency practitioners also communicate with stakeholders, including employees, shareholders, and creditors. They provide regular updates on the insolvency process and handle queries from all parties involved.

Qualifications and Licensing Requirements

To become an insolvency practitioner, individuals must meet rigorous educational and professional standards. Typically, they hold relevant degrees in law, accountancy, or business.

Aspiring practitioners must complete specialised insolvency training and gain substantial practical experience. This often involves working under a licensed practitioner for several years.

Licensing is mandatory and requires passing challenging exams. In the UK, practitioners are licensed by recognised professional bodies, such as:

- Insolvency Practitioners Association (IPA)

- Institute of Chartered Accountants in England and Wales (ICAEW)

- Association of Chartered Certified Accountants (ACCA)

Continuous professional development is essential to maintain the licence.

The Legal Authority of Insolvency Practitioners

Insolvency practitioners derive their authority from the Insolvency Act 1986 and subsequent legislation. This legal framework empowers them to act on behalf of insolvent companies.

Their powers include:

- Taking control of company assets

- Investigating directors’ conduct

- Voiding certain transactions

- Pursuing legal claims on behalf of the company

Practitioners must adhere to strict ethical guidelines and professional standards. They are bound by a code of conduct that ensures they act with integrity and in the best interests of creditors.

Courts oversee the work of insolvency practitioners and can intervene if necessary. This judicial oversight provides a safeguard against potential misconduct and ensures practitioners fulfil their duties correctly.

When Should a Business Consult an Insolvency Practitioner?

Recognising financial distress early and seeking professional advice promptly can make a significant difference in the outcome for struggling businesses. Timely consultation with an insolvency practitioner provides more options and increases the chances of successful turnaround or orderly resolution.

Early Signs of Financial Trouble

Watch for these warning signs that indicate it’s time to consult an insolvency practitioner:

- Persistent cash flow problems

- Difficulty paying suppliers or staff on time

- Mounting debts and creditor pressure

- Declining sales or profit margins

- Bounced cheques or declined payments

- Maxed out credit lines

If you notice these issues, don’t wait for them to worsen. Seeking advice early gives you more time to explore restructuring options and potentially avoid formal insolvency proceedings.

Legal Obligations During Insolvency

Directors have legal duties to act in creditors’ best interests when a company becomes insolvent. You must:

- Avoid taking on new credit you can’t repay

- Stop trading if there’s no reasonable prospect of avoiding insolvency

- Prioritise creditor interests over shareholders

Consulting an insolvency practitioner helps ensure you fulfil these obligations and protects you from wrongful trading allegations. They can advise on when to cease trading and how to manage creditor relationships during this critical period.

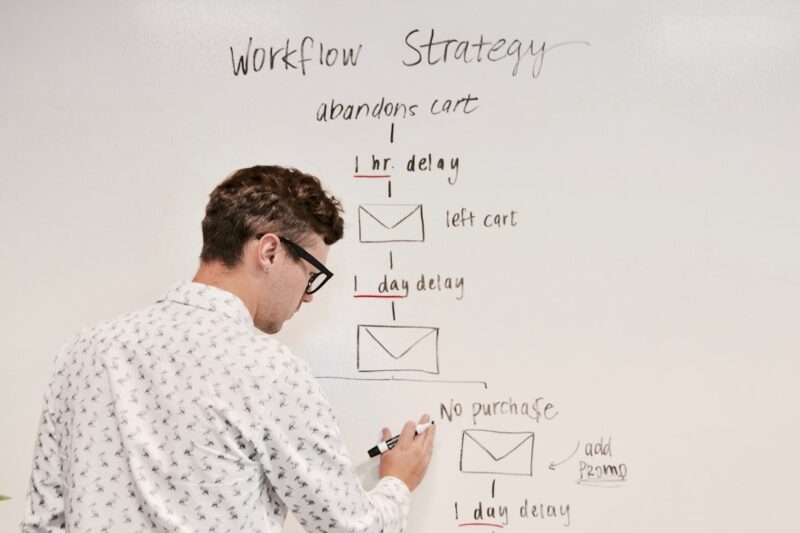

Timing Matters: Why Acting Quickly is Crucial

Swift action can make the difference between rescue and liquidation. Benefits of early consultation include:

- More restructuring options available

- Better chance of securing additional funding

- Opportunity to negotiate with creditors

- Time to plan an orderly wind-down if necessary

Delaying only reduces your choices and increases creditor losses. An insolvency practitioner can quickly assess your situation and recommend the most appropriate course of action, whether that’s refinancing, a company voluntary arrangement, or an orderly closure.

The Core Duties of Insolvency Practitioners

Insolvency practitioners play a crucial role in guiding companies through financial distress. They assess situations, provide expert advice, and manage complex processes to achieve the best possible outcomes for all parties involved.

Assessing a Company’s Financial Position

When you engage an insolvency practitioner, their first task is to conduct a thorough evaluation of your company’s financial health. They will:

- Review your accounts, assets, and liabilities

- Analyse cash flow and profit and loss statements

- Examine contracts and outstanding debts

- Investigate potential assets that could be realised

This comprehensive assessment allows the practitioner to gain a clear picture of your company’s situation. They’ll identify the root causes of financial difficulties and determine the severity of the insolvency.

Advising on Viable Options: Rescue, Restructure, or Liquidation

Based on their assessment, insolvency practitioners will present you with potential courses of action. These may include:

- Company rescue plans (e.g. Company Voluntary Arrangement)

- Restructuring strategies

- Controlled wind-down procedures

- Formal liquidation processes

They’ll explain the pros and cons of each option, considering factors such as:

- Potential for business recovery

- Impact on creditors and employees

- Legal obligations and regulatory compliance

- Timelines and costs involved

Their expertise helps you make informed decisions about your company’s future.

Managing Assets, Debts, and Stakeholder Expectations

Once a course of action is chosen, insolvency practitioners take on a crucial management role. Their responsibilities include:

- Safeguarding and valuing company assets

- Negotiating with creditors to reach fair settlements

- Overseeing the sale of assets or the entire business

- Distributing funds to creditors according to legal priorities

They also act as a liaison between various stakeholders, including:

- Directors and shareholders

- Employees

- Creditors and suppliers

- Regulatory bodies

Insolvency practitioners must balance competing interests whilst adhering to strict legal and ethical standards. Their goal is to achieve the best possible outcome for all parties involved, given the challenging circumstances.

advice@andersonbrookes.co.uk or freephone number – 0800 1804 933

How Insolvency Practitioners Support Different Processes

Insolvency practitioners play crucial roles in various corporate insolvency processes. They guide companies through financial difficulties, aiming for recovery or ensuring compliant closure. These professionals offer tailored solutions based on each company’s unique circumstances.

Administration: Aiming for Recovery

When a company enters administration, an insolvency practitioner takes control to rescue the business. They assess the company’s financial position and develop a strategy for recovery. This may involve restructuring operations, negotiating with creditors, or selling parts of the business.

You’ll find that administrators work to:

- Protect the company from creditor actions

- Continue trading if viable

- Preserve jobs where possible

- Maximise returns for creditors

During this process, the insolvency practitioner acts as a neutral party, balancing the interests of all stakeholders. They provide regular updates to creditors and seek their approval for major decisions.

Liquidation: Closing Down with Compliance

In a liquidation, the insolvency practitioner’s role is to wind up the company’s affairs in an orderly manner. This involves:

- Realising company assets

- Settling debts with creditors

- Distributing any remaining funds to shareholders

You’ll see the liquidator handle legal obligations, such as filing final accounts and striking the company off the register. They ensure all procedures comply with UK insolvency laws.

For creditors, the liquidator provides:

- Clear communication about the process

- Fair distribution of available funds

- Investigation of any potential wrongdoing by directors

Company Voluntary Arrangements (CVA): Structured Settlements

A CVA allows a struggling company to reach an agreement with creditors to repay debts over time. The insolvency practitioner acts as a supervisor, helping to:

- Propose a realistic repayment plan

- Negotiate terms with creditors

- Oversee the implementation of the arrangement

You’ll find that CVAs often involve:

- Reduced debt payments

- Extended repayment periods

- Potential debt write-offs

The insolvency practitioner ensures the company adheres to the agreed terms and reports to creditors regularly. They monitor cash flow and adjust the plan if necessary, aiming to keep the business afloat while satisfying creditor demands.

What Sets Insolvency Practitioners Apart?

Insolvency practitioners play a unique role in navigating financial distress. They bring specialised expertise and impartiality to complex situations, balancing the interests of multiple parties whilst adhering to strict legal requirements.

Acting as a Neutral Party for All Stakeholders

Insolvency practitioners serve as impartial mediators between various stakeholders. They balance the interests of creditors, directors, employees, and shareholders. This neutrality is crucial in making fair decisions about a company’s future.

Their role involves:

- Assessing the company’s financial position objectively

- Communicating transparently with all parties involved

- Making unbiased recommendations for the best course of action

By maintaining neutrality, practitioners help build trust and facilitate smoother negotiations. This can lead to more favorable outcomes for all parties, even in challenging circumstances.

Combining Legal Knowledge with Financial Expertise

Insolvency practitioners possess a unique blend of legal and financial acumen. This combination allows them to:

- Interpret complex insolvency laws and regulations

- Analyse financial statements and cash flow projections

- Develop restructuring plans that comply with legal requirements

Their expertise extends to:

- Tax implications of insolvency procedures

- Creditor rights and priorities

- Corporate governance during financial distress

This multidisciplinary knowledge enables practitioners to provide comprehensive solutions. They can navigate the legal intricacies of insolvency whilst addressing the financial realities of struggling businesses.

Ensuring Compliance with Insolvency Laws

Insolvency practitioners are bound by strict regulatory frameworks. They must:

- Adhere to the Insolvency Act 1986 and other relevant legislation

- Follow guidelines set by professional bodies and regulators

- Maintain accurate records of all proceedings and decisions

Key compliance responsibilities include:

- Protecting creditor interests

- Reporting on directors’ conduct

- Ensuring fair distribution of assets

Practitioners face severe penalties for non-compliance, including fines and loss of licence. This rigorous oversight helps maintain the integrity of the insolvency process and protects all parties involved.

Key Considerations When Choosing an Insolvency Practitioner

Selecting the right insolvency practitioner is crucial for navigating financial difficulties effectively. A qualified professional can guide you through complex processes and help achieve the best possible outcomes.

Verifying Licences and Professional Memberships

Ensure your chosen practitioner holds valid licences and memberships. In the UK, insolvency practitioners must be authorised under the Insolvency Act 1986. Check their credentials with regulatory bodies like the Insolvency Practitioners Association.

Look for memberships in professional organisations such as R3 (Association of Business Recovery Professionals). These affiliations indicate a commitment to industry standards and ongoing professional development.

Request proof of their licence and ask about their registration number. You can verify this information on the official registers of licensed practitioners maintained by regulatory authorities.

Assessing Experience with Similar Cases

Evaluate the practitioner’s track record with cases similar to yours. Ask about their experience in your specific industry and with businesses of comparable size and complexity.

Inquire about their success rates in achieving positive outcomes for clients. While past results don’t guarantee future performance, they can provide insights into the practitioner’s capabilities.

Request case studies or anonymised examples of how they’ve handled situations like yours. This can give you a clearer picture of their approach and problem-solving skills.

Consider the practitioner’s specialisations. Some may focus on certain types of insolvency procedures or industries, which could be beneficial for your situation.

Questions to Ask Before Appointing

Prepare a list of essential questions to ask potential insolvency practitioners:

- What is your proposed strategy for my case?

- How do you communicate with clients throughout the process?

- What are your fees and how are they structured?

- Can you provide references from previous clients?

- How long do you expect my case to take?

- What potential challenges do you foresee?

Ask about their availability and the level of personal attention you can expect. Will you work directly with the licensed practitioner or with junior staff?

Discuss their approach to creditor negotiations and how they aim to protect your interests. Understanding their methods can help you gauge their suitability for your needs.

What Happens If You Don’t Use an Insolvency Practitioner?

Failing to engage an insolvency practitioner when your company faces financial difficulties can lead to serious consequences. You may inadvertently break insolvency laws, expose yourself to personal liability, and leave creditors without proper protection.

Risks of Non-Compliance with Insolvency Laws

Without an insolvency practitioner’s guidance, you might unknowingly violate strict regulations governing insolvent companies. These laws are complex and require specialist knowledge to navigate properly.

Potential pitfalls include:

- Continuing to trade whilst insolvent

- Improperly disposing of company assets

- Failing to follow correct procedures for creditor payments

Breaching these laws can result in hefty fines, director disqualification, and even criminal charges in severe cases. An insolvency practitioner helps ensure you comply with all relevant legislation throughout the process.

Increased Risk of Personal Liability for Directors

Directors who don’t seek professional advice may find themselves personally liable for company debts. This can happen if you:

- Make preferential payments to certain creditors

- • Fail to act in creditors’ best interests

- • Continue trading when there’s no reasonable prospect of avoiding insolvency

An insolvency practitioner can help protect you from these risks by advising on proper conduct and ensuring all decisions are properly documented and justified.

Limited Protection for Creditors

Without an insolvency practitioner, creditors may not receive fair treatment or maximum returns. You might struggle to:

- Accurately value and realise company assets

- Distribute funds equitably among creditors

- Investigate potential claims against third parties

Insolvency practitioners have the skills and authority to maximise recoveries for creditors. They can negotiate with creditors, challenge unfair claims, and pursue legal action if necessary to recover funds.

By working with an insolvency practitioner, you ensure a transparent process that protects creditors’ interests and minimises the risk of disputes or legal challenges.

Why Anderson Brookes is the Partner You Need

Anderson Brookes offers expert insolvency guidance tailored to your unique situation. Our proven track record, personalised approach for businesses of all sizes, and free initial consultations make them a trusted partner for navigating financial challenges.

A Proven Track Record in Insolvency Management

Anderson Brookes has established itself as a reliable insolvency practitioner with years of experience – our team of highly skilled advisers specialise in addressing a wide range of debt-related issues for individuals and businesses alike.

We have successfully helped numerous clients overcome financial difficulties, from personal debt to complex corporate insolvencies, including:

- Dealing with CCJs

- Resolving HMRC tax debts

- Avoiding bailiff actions

- Navigating limited company debts

Anderson Brookes’ consistent success in managing insolvencies demonstrates our capability to guide you through even the most challenging financial situations.

Free Initial Consultations to Explore Your Options

Anderson Brookes offers free initial consultations, giving you the opportunity to discuss your financial situation without any obligation. This service allows you to:

- Gain clarity on your financial position

- Explore potential debt solutions

- Understand the insolvency process

During these consultations, our experienced advisers will listen to your concerns and provide an honest assessment of your options. You’ll receive guidance into possible debt resolution strategies tailored to your specific circumstances.

This no-cost, no-pressure approach demonstrates Anderson Brookes’ commitment to helping you make informed decisions about your financial future. It’s an excellent way to start your journey towards financial stability without any upfront investment.

Insolvency Practitioner Google Reviews for Anderson Brookes

&

Frequently Asked Questions

Insolvency practitioners play a crucial role in managing financial distress for companies and individuals. They have specific responsibilities, qualifications, and legal obligations that shape their work with struggling businesses and creditors.

What responsibilities does an insolvency practitioner hold in the UK?

Insolvency practitioners in the UK have a duty to act in the best interests of creditors. They must manage the affairs of insolvent entities, either rescuing them or realising assets for creditors’ benefit.

Practitioners are required to assist in understanding the company’s financial situation and may need to attend creditor meetings to answer questions.

How does one qualify and become an insolvency practitioner?

To become an insolvency practitioner in the UK, you must be licensed and authorised by a Recognised Professional Body. This typically involves completing specialised training and examinations in insolvency law and practice.

Ongoing professional development is essential to maintain the licence and stay current with industry regulations.

What is the difference between an insolvency practitioner and a liquidator?

An insolvency practitioner is a broader term encompassing various roles in managing financial distress. A liquidator is a specific type of insolvency practitioner appointed to wind up a company’s affairs.

All liquidators are insolvency practitioners, but not all insolvency practitioners act as liquidators.

What services can an insolvency practitioner provide to a struggling company?

Insolvency practitioners offer a range of services to struggling companies. These may include:

- Assessing the company’s financial situation

- Advising on restructuring options

- Negotiating with creditors

- Implementing turnaround strategies

- Managing formal insolvency procedures like administrations or liquidations

How is an insolvency practitioner remunerated for their services?

Insolvency practitioners are typically paid from the assets of the insolvent company or individual. Their fees must be approved by creditors or the court, depending on the type of insolvency procedure.

Remuneration can be based on time spent, a fixed fee, or a percentage of assets realised.

What legal obligations does an insolvency practitioner have towards creditors?

Insolvency practitioners have a legal duty to act in the best interests of all creditors. They must:

- Provide regular updates on the insolvency process

- Distribute available funds fairly among creditors

- Investigate the conduct of company directors

- Report any misconduct or fraudulent activities

Practitioners must also maintain transparency and adhere to strict ethical guidelines throughout the insolvency process.