UK Construction Insolvency and Liquidation: Understanding Risks and Preventing Financial Distress

Current Challenges in the UK Construction Industry

The UK construction industry is currently experiencing severe financial pressures, evidenced by the latest insolvency and liquidation statistics. According to the Insolvency Service, construction firms accounted for 16.3% of all insolvencies and liquidations in England and Wales in December 2024, with a total of 4,032 construction companies becoming insolvent or entering liquidation during the year.

This represents a significant increase of 25.3% compared to pre-pandemic levels in 2019, making construction the sector most impacted, ahead of wholesale, retail, accommodation, and food services.

Construction insolvency has several key drivers. Specialised subcontractors, including electricians, plumbers, plasterers, painters, and glazing firms, are particularly vulnerable. These businesses often rely on fixed-price contracts, which make them highly sensitive to sudden increases in material and labour costs, leading to severe cash flow issues, insolvency, and potentially liquidation.

At Anderson Brookes, we have worked with hundreds of business directors and owners of construction businesses. We provide an efficient service and advice to help those in financial distress make the right decisions. We know time is often of the essence with debt management so we can also place a company into liquidation within 8 days.

This article highlights how to avoid this, uses examples and refers to Government legislation which has come into place this month (Feb 2025) which should further help construction contractors avoid insolvency through better procurement, terms and contract management.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Major Issues Affecting Construction Businesses

Larger construction companies are also facing significant challenges. Recent analysis has shown that over half of the major listed construction businesses have issued profit warnings. Common issues include delayed project starts, excess inventory, and reductions in orders, creating substantial financial strain and increasing the risk of insolvency and liquidation across the industry.

Broader economic pressures further compound these issues. There has been a notable increase in the number of UK businesses facing severe financial difficulties, largely due to aggressive debt recovery actions by HMRC, increased tax burdens, higher National Insurance contributions, rising energy costs, and ongoing inflationary pressures. These factors are particularly damaging to industries such as retail, hospitality, and construction, which operate on very narrow profit margins, leaving them at greater risk of insolvency and liquidation.

High-Profile Insolvencies and Broader Industry Risks

High-profile insolvencies and liquidations in the construction sector highlight deeper systemic risks. A recent example includes a construction firm director who was jailed for fraudulently obtaining government-funded Bounce Back Loans. Misuse of support schemes damages the industry’s overall reputation and undermines trust, emphasising the need for robust financial oversight and ethical governance.

The collapse of major construction firms has also highlighted significant vulnerabilities within the industry’s business models. Issues such as extremely narrow profit margins, extensive reliance on subcontracting, problematic cash flow management, and lingering financial impacts from the pandemic have contributed significantly to recent high-profile insolvencies and liquidations. These collapses leave numerous projects incomplete, subcontractors unpaid, employees unemployed, and trigger widespread disruption within the broader supply chain.

Recent Example of Insolvency: Construction Specialist Faces Administration

The precarious nature of the construction sector was further highlighted by the recent administration application filed by Cannock-based building service specialist TNA Electrical. Despite a substantial turnover of £30 million and handling projects worth up to £12 million, the mechanical and electrical services specialist encountered significant financial difficulties due to substantial losses.

Founded in 2009, TNA Electrical had grown to become a prominent player in the industry. However, according to their latest accounts for the year ending January 31, 2024, the company reported a pre-tax loss of £2.1 million, despite generating a turnover of £30 million and employing 25 staff.

This case emphasises the urgent need for robust financial planning and risk management in the construction industry, even for well-established firms with seemingly strong market positions. The challenges faced by TNA Electrical serve as a stark reminder that no company is immune to the potential pitfalls of the sector, and that proactive measures must be taken to mitigate insolvency risks.

As the industry continues to navigate the complexities of the current economic landscape, it is crucial for construction companies to prioritise sound financial practices, diversify their client bases, and remain vigilant in monitoring their financial health to ensure long-term stability and success.

How to Spot the Warning Signs of Insolvency and Liquidation in the Construction Supply Chain

Spotting early warning signs of insolvency and potential liquidation is crucial. Contractors should monitor for indicators such as delayed or missed payments, requests for payment extensions or advanced payments, unusual disputes or claims, unexpected behavioural changes among business partners, reduced workforce attendance, slowing project progress, declining workmanship quality, and delays in filing financial accounts. Swift action in response to these signs, including immediate communication, negotiation, seeking adjudication, and prompt legal advice, can help mitigate financial impacts and secure payments before insolvency occurs.

Quick Checklist: Warning Signs of Potential Insolvency

- Payment Problems: Delays, missed payments, or changes in normal payment patterns.

- Behavioural Changes: Increased aggression, defensiveness, or reduced communication.

- Contractual Changes: Unexpected requests to alter payment terms or project scope.

- Workforce Issues: Reduced site attendance, changes in management, or reduced deliveries of materials.

- Quality Concerns: Noticeable declines in the standard of work, possibly indicating financial strain.

- Administrative Issues: Delays in filing accounts or statutory returns at Companies House.

- Market Rumours: Rumours, creditor actions, or public announcements indicating financial instability.

Practical Steps for Contractors to Mitigate Insolvency and Liquidation Risks

To reduce insolvency and liquidation risks, construction companies should adopt comprehensive financial controls and effective cash flow management practices. Here are some practical steps contractors can take to mitigate insolvency and liquidation risks in construction projects:

-

Improve cash flow management: Careful cash flow forecasting, invoicing promptly, and following up on overdue payments are critical. Consider using electronic payment platforms or project bank accounts to ensure secure and timely payments. Improving cash flow management is one of the key tips to help reduce the risk of insolvency, even in a challenging economy.

-

Conduct thorough due diligence: Before entering into contracts, research the financial stability, payment history, and reputation of potential clients and partners. Due diligence is critical to mitigating the impacts of contractor insolvency.

-

Draft strong contracts: Work with experienced construction lawyers to draft contracts that protect your interests, clarify payment terms, and include provisions for dealing with insolvency events. Drafting strong contracts is a key step to avoid a construction catastrophe.

-

Diversify your portfolio: Avoid over-reliance on a single client or project. Diversifying your work portfolio can mitigate financial risks if one developer or project faces issues.

-

Monitor projects closely: Regularly review contracts, track progress on-site, and address any early warning signs of financial distress. Monitoring the contract and work on-site remains critical to cope with potential insolvency issues.

-

Conduct regular financial audits: Implement comprehensive financial controls, monitor profit margins closely, and regularly review your company’s financial health to identify and address any potential issues early.

By adopting these proactive strategies, construction companies can significantly reduce their exposure to insolvency and liquidation risks, protecting their business and ensuring long-term success in the industry.

How Anderson Brookes Supports Construction Contractors

Anderson Brookes provides specialist support to directors, business owners, and construction professionals to manage insolvency and liquidation risks effectively. Our expertise helps you recognise potential challenges early, allowing informed and strategic decisions to protect your business and projects.

We have our own in-house Insolvency Practitioner licensed by the Institute of Chartered Accountants in England & Wales and we offer tailored services specifically for directors and business owners in construction and related sectors, including:

Compliance and Legal Support:

We help you navigate complex insolvency legislation and ensure full regulatory compliance. Our team expertly manages creditor negotiations, reducing your stress and minimising financial impact.

Recovery and Restructuring: We specialise in developing recovery strategies and restructuring plans tailored to your unique business circumstances. Our solutions focus on stabilising operations, maximising asset values, and enhancing long-term sustainability.

Compliance and Legal Support: Our compliance specialists guide you through the complex regulatory landscape, ensuring full adherence to legal requirements. From creditor negotiations to navigating regulatory obligations, we help mitigate risk and safeguard your business reputation.

Anderson Brookes’ comprehensive service ensures that you remain fully informed and equipped to navigate the intricacies of insolvency and liquidation confidently and compliantly.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Construction Voluntary Liquidation Process – Quick Example

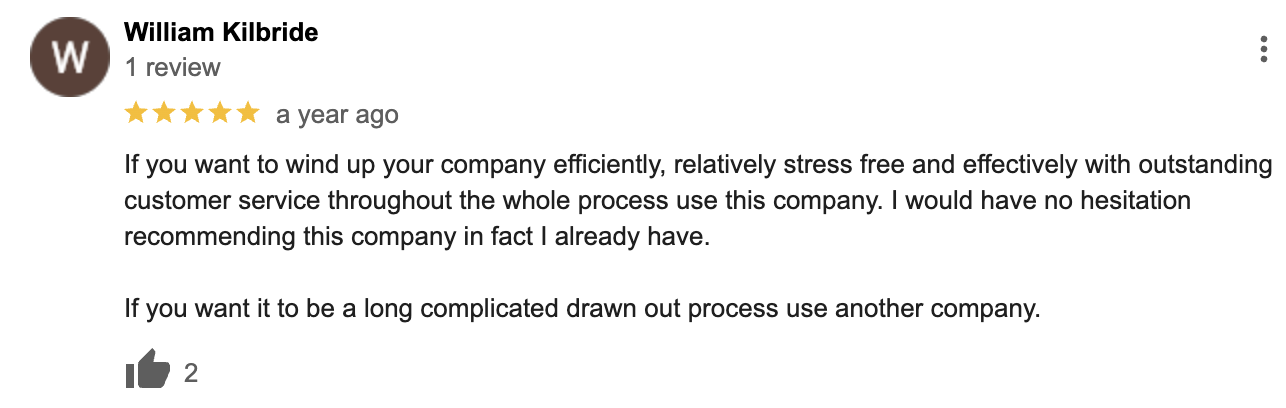

Construction Insolvency Google Reviews

&

The Role of Government in Addressing Construction Insolvency and Liquidation

The UK Government plays an important role in addressing insolvency challenges within the construction industry. The introduction of the Procurement Act 2023, effective from February 2025, aims to improve flexibility when working with contractors.

This legislation supports better payment terms and highlights the importance of quality and social value by shifting from “Most Economically Advantageous Tender (MEAT)” to “Most Advantageous Tender (MAT)” as an evaluation method. While cost remains important, greater emphasis is placed on quality and the broader social impact of construction projects.

Addressing Broader Industry Issues

A significant shortage of skilled labour, estimated at around 250,000 workers, continues to hamper the industry. Despite government efforts to streamline training processes and encourage workforce development, this labour gap remains a critical challenge, further straining contractors’ capacity to deliver efficiently.

Economic conditions remain uncertain, with consumer confidence falling and spending declining, particularly impacting businesses with tight profit margins. Nevertheless, falling interest rates may offer some optimism, potentially boosting demand and strengthening order books.

Careful risk management, diligent contract oversight, and financial prudence remain essential for construction firms navigating these complex challenges successfully. Anderson Brookes provides specialist insolvency and liquidation advice and practical solutions, enabling construction contractors to overcome financial difficulties and maintain sustainable business operations.