What Happens to Directors When Closing with Debt?

Anderson Brookes Insolvency Practitioners help directors close limited companies with debt quickly, legally and with expert guidance every step of the way.

Free Advice & Same Day Quote

Impact & Consequences Explained

If you’re a director of a company that can’t pay its debts, it’s natural to feel uncertain or even overwhelmed. But closing a company with debt doesn’t automatically mean you’ll face personal financial ruin or be banned from running another business. What matters is how you act once you realise the company is insolvent.

This page explains what happens to company directors during and after insolvency, and what steps you can take to stay on the right side of the law while protecting your personal position.

Talk to Us Today

If your company is struggling with debt and you’re unsure what it means for you personally, speak to our licensed insolvency practitioners for free, confidential advice.

Free Advice Line: 0800 1804 935

Email: advice@andersonbrookes.co.uk

Clear, calm, expert support when you need it most. Don’t wait for creditors to take control – speak to Anderson Brookes today.

Your Legal Duties Change When a Company Becomes Insolvent

When a business is solvent, directors must act in the best interests of shareholders. However, once the company becomes insolvent – meaning it can’t pay its debts – your legal duty shifts. From that moment, directors must prioritise creditors’ interests. Continuing to trade, moving assets, or favouring certain creditors could result in wrongful trading allegations and personal consequences. You may also be interested in our insolvency FAQs.

Attempting Strike Off with Debt – What Directors Need to Know

If you try to close an indebted company by applying for strike off (also known as dissolution), this can backfire. Strike off is only suitable for solvent companies. If your business has debts, creditors like HMRC can object to the strike off and may instead apply to forcibly wind up the company. Even if the strike off goes through, creditors can later apply to have the company restored to the register and pursue directors directly if misconduct is suspected.

To avoid these risks, always seek professional advice before choosing your closure method.

Liquidation: What Happens to Directors?

If your company enters Creditors’ Voluntary Liquidation (CVL), a licensed insolvency practitioner takes over full control. You will no longer manage the business day-to-day, but you will still have responsibilities. These include providing the company’s financial records, assisting the insolvency practitioner, and cooperating with any investigations.

Here’s how different director situations are typically assessed:

| Situation | Outcome or Risk |

|---|---|

| Signed personal guarantees | You remain liable for those specific debts |

| Trading while insolvent | Could lead to wrongful trading accusations |

| Misuse of company funds or assets | Investigated for misconduct or misfeasance |

| Overdrawn director’s loan account | May need to repay part or all of the balance |

| Keeping poor records | Potential breach of statutory duties |

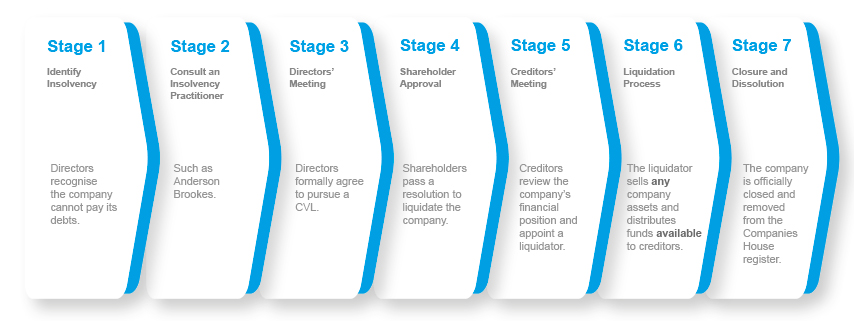

CVL Steps

Can you liquidate your limited company?

Will There Be an Investigation?

Yes, a review of director conduct is a routine part of the liquidation process. Your appointed insolvency practitioner will submit a report to the Insolvency Service. Most directors face no repercussions at all. However, if misconduct is found – such as taking excessive salary while insolvent, favouring certain creditors, or failing to keep proper records – this could lead to disqualification or personal liability.

Key Questions Directors Often Ask

| Question | Answer |

| Can I start a new company? | Yes, unless you’re disqualified. |

| Will I owe company debts? | Only if you gave personal guarantees or broke the law. |

| Will I be investigated? | Yes, but this is routine and not a sign of wrongdoing. |

| Can I claim redundancy? | If PAYE-registered and eligible, yes. |

What About My Future as a Director?

In most cases, directors are free to start or manage a new company after liquidation. You are only restricted if you’re formally disqualified due to misconduct. One thing to note: if your company goes into liquidation, you’re not allowed to reuse the same or a similar company name for five years without court approval.

Take Early Action – It Makes All the Difference

The earlier you act, the more protection and control you’ll have. Leaving things too late can lead to HMRC or other creditors starting legal proceedings, which often results in a more stressful, costly, and risky process.

At Anderson Brookes, we work with directors every day who feel like they’re out of options – but there is always a solution. We’ll help you understand the process, your responsibilities, and how to manage the risks.

Am I Entitled to Redundancy Pay as a Director?

If you’ve worked for your company in a practical role (not just as a shareholder) and received a salary through PAYE for at least two years, you may be eligible for director redundancy and other statutory entitlements. Many directors use this payment to help cover the cost of liquidation and provide a financial cushion during the transition.

Testimonials

Our clients praise our professionalism, reliability, and the exceptional support we provide during challenging times, helping thousands of company directors through insolvency, liquidation, and business debt solutions.

What if I’m a Sole Trader or Facing Personal Debt?

While this page focuses on directors of limited companies, we also speak to many individuals who run businesses as sole traders or who are personally liable for debts after closure.

If you’re not a company director, but your business debts are affecting you personally, there are still regulated options available. These include:

| Scenario | Example Solutions |

|---|---|

| Personal credit cards, loans, or guarantees linked to a failed business | Debt Management Plan (DMP), Individual Voluntary Arrangement (IVA), or Bankruptcy |

| Tax arrears or Bounce Back Loan used in personal name | Time to Pay with HMRC, or insolvency solutions depending on circumstances |

| Sole trader business debts (HMRC, suppliers, landlords) | IVA or Bankruptcy, depending on income, assets and liabilities |

We’ll take time to understand your position and explain what steps are possible. There’s no single route that suits everyone. Whether debts came from your role in a limited company, a self-employed business, or personal borrowing to support your work, we’ll help you get clarity.

This support is confidential, regulated, and designed to give you a fresh start.

📞 Speak to us today: 0800 1804 935

📩 Email: advice@andersonbrookes.co.uk