Hotels and Hospitality Business Liquidation Advice: Navigating Closures Effectively

Financial Challenges for Hotels and Hospitality Businesses

Impact of the COVID-19 Pandemic

The hospitality sector has faced unprecedented difficulties due to the COVID-19 pandemic. Many hotels and hospitality businesses have struggled to stay afloat amidst lockdowns, travel restrictions, and reduced consumer confidence. The brief trading window in summer 2020 proved insufficient for numerous establishments to recover from financial setbacks.

Factors contributing to the sector’s struggles include:

- Sudden implementation of restrictions

- Hesitancy among potential guests

- Decline in business travel

- Shift towards virtual meetings and conferences

If you’re a hotel or hospitality business owner facing financial challenges, it’s crucial to seek professional advice promptly. While liquidation may seem like the only option, other possibilities might exist to help your business survive.

Professional Guidance for Hotel and Hospitality Businesses

Seeking expert advice is essential when your business faces financial difficulties. A licensed insolvency practitioner can:

- Assess your current financial position

- Present viable options

- Guide you through potential restructuring

Restructuring may involve streamlining operations to create a more agile business model better equipped to handle challenging market conditions. This approach could help your business navigate the current economic landscape more effectively.

Understanding Creditors’ Voluntary Liquidation

If liquidation becomes necessary, Creditors’ Voluntary Liquidation (CVL) is a common route for hotel and hospitality businesses. This process ensures your company closes in compliance with insolvency laws, protecting you from potential wrongful trading allegations.

Key aspects of CVL:

- Directors can choose when to initiate the process

- You can select your own liquidator (must be a licensed insolvency practitioner)

- Company assets are professionally valued and sold at auction

- Proceeds are distributed to creditors according to statutory order

- Remaining debts can be written off, unless personal guarantees are in place

It’s worth noting that eligible staff members may claim redundancy pay in a CVL scenario.

Hotel Voluntary Liquidation Process – 7 Steps

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Director Redundancy Claims

As a company director, you might be eligible for redundancy pay and other statutory entitlements when liquidating your business. Eligibility criteria include:

- Working under an employment contract for at least two years

- Receiving a regular salary through PAYE

- Working a minimum of 16 hours weekly

- Being owed money by the business

- Fulfilling a role beyond advisory capacity

| Eligibility Criteria | Requirement |

|---|---|

| Employment duration | 2+ years |

| Salary | Regular, via PAYE |

| Weekly hours | 16+ hours |

| Company debt to director | Any amount |

| Role | Beyond advisory |

Remember, liquidation isn’t always the sole option. Exploring alternatives with a professional may reveal opportunities to save your business.

Exploring Business Rescue Options

Before considering liquidation, it’s worth investigating potential rescue measures for your hotel or hospitality business. Some possibilities include:

- Company Voluntary Arrangement (CVA): A formal agreement to restructure debts, potentially allowing continued trading.

- Business Streamlining: Identifying and removing unprofitable elements to create a leaner, more efficient operation.

- Administration: Appointing an administrator to manage the business and explore rescue options.

- Time to Pay Arrangements: Negotiating extended payment terms with creditors, including HMRC.

- Asset Refinancing: Releasing equity from business assets to improve cash flow.

While these options may involve difficult decisions, such as staff redundancies, they could provide a path to long-term survival and eventual recovery.

Seeking professional advice is crucial when considering these alternatives. An experienced insolvency practitioner can provide a comprehensive assessment of your situation and guide you towards the most appropriate solution for your business.

Remember, acting quickly when facing financial difficulties can significantly increase your chances of finding a positive resolution. Don’t hesitate to reach out to insolvency experts who can offer a free initial consultation to evaluate your options and help you make informed decisions about your hotel or hospitality business’s future.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Frequently Asked Questions

How do you begin liquidating a hotel?

The initial steps involve assessing your financial situation and seeking professional advice. Contact an insolvency practitioner to review your options. They’ll help determine if liquidation is necessary or if other solutions exist. If liquidation proceeds, you’ll need to inform stakeholders, including staff, suppliers and guests with future bookings.

Can creditors recoup money from a liquidated hotel?

Creditors may recover some funds, but full repayment is rare. A liquidator will sell the hotel’s assets and distribute proceeds according to a legal priority order. Secured creditors are paid first, followed by preferential creditors like employees. Unsecured creditors often receive only a small percentage, if anything.

What must hotel directors do during liquidation?

Directors have key responsibilities during liquidation. You must cooperate fully with the appointed liquidator, providing all necessary financial records and information. Avoid any actions that could be seen as wrongful trading. Be prepared to explain past business decisions and transactions if required.

How might liquidation affect hotel staff?

Liquidation typically results in job losses. Employees become preferential creditors for certain unpaid wages and holiday pay. The government’s Redundancy Payments Service may cover some entitlements. Staff should receive clear communication about the situation and their rights.

What alternatives exist to hotel liquidation?

Several options may help avoid liquidation:

- Company Voluntary Arrangement (CVA)

- Administration

- Refinancing or restructuring debt

- Finding new investors

- Selling the business as a going concern

Each option has pros and cons. Professional advice is crucial to determine the best path forward.

What triggers compulsory liquidation for hotels?

Compulsory liquidation occurs when a creditor petitions the court to wind up your company, usually due to unpaid debts. Common triggers include:

- Failing to pay a statutory demand over £750

- Defaulting on tax liabilities to HMRC

- Breaching loan agreements with banks or other lenders

Acting quickly when facing financial difficulties can help avoid this outcome.

Understanding Insolvent Liquidation

Liquidation involves winding down your company’s affairs under the supervision of an insolvency practitioner. Your business assets are sold at auction, with the proceeds used to repay creditors. As the company is insolvent, not all creditors will receive full repayment, and unsecured creditors rarely benefit from asset sales.

The process concludes with:

- Your company name being removed from the Companies House register

- Any remaining debts being written off

Potential Consequences for Company Directors

When your business becomes insolvent, your primary duty is to prioritise your creditors’ interests. Failure to do so could result in allegations of misconduct or wrongful trading following the liquidator’s investigations.

Risks of not acting promptly include:

- Disqualification as a director for up to 15 years

- Personal liability for additional debts incurred by creditors

Voluntary liquidation demonstrates your commitment to prioritising creditors and may make you eligible for director redundancy pay.

Redundancy Claims for Company Leaders

You may be able to claim redundancy pay as a director if:

- You’ve worked under an employment contract for at least two years

- You receive a regular salary through PAYE

The average claim for director redundancy is £9,000, which could provide valuable financial support during this difficult time.

To determine your eligibility for redundancy and explore your options, it’s advisable to seek professional advice. Many insolvency practitioners offer free initial consultations and can provide tailored guidance based on your specific circumstances.

Remember, while the closure of your festival or live music company can be challenging, understanding your rights and responsibilities can help you navigate the process more effectively.

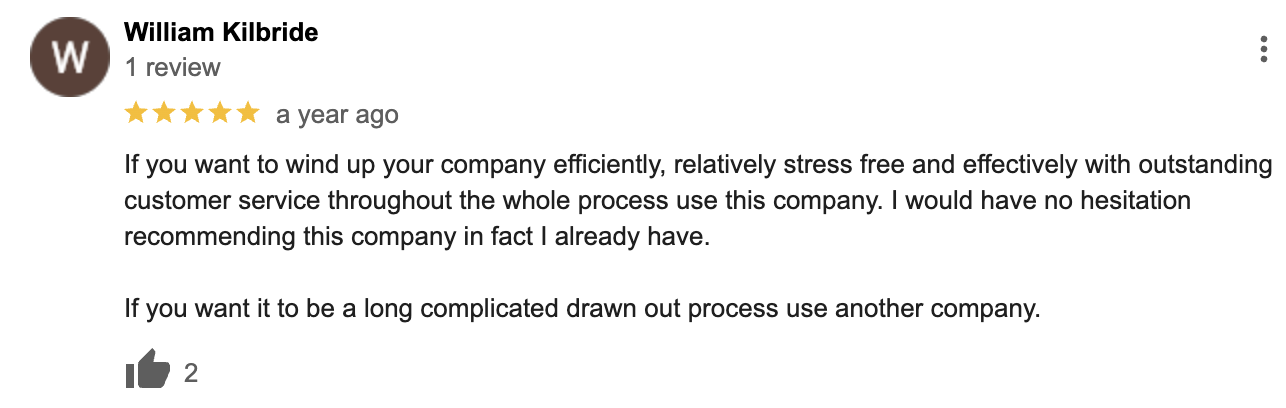

Liquidation – Google Reviews

&