When Do You Need a Licensed Insolvency Practitioner?

Anderson Brookes Insolvency Practitioners help directors close limited companies with debt quickly, legally and with expert guidance every step of the way.

Speak to us today

Situations When a Licensed Insolvency Practitioner is Essential

Knowing when to involve a Licensed Insolvency Practitioner (IP) can be difficult, especially when managing day-to-day business pressures. However, recognising the right moment is crucial, as early intervention typically provides more choices and better outcomes for directors, creditors, and employees alike.

| Scenario | Explanation |

|---|---|

| Constant Cash Flow Challenges | Your business consistently struggles with payments to suppliers, staff wages, or essential bills, signalling deep-rooted financial issues. |

| Increasing Pressure from Creditors | Creditors escalating their actions by issuing legal notices, CCJs, or bailiffs becoming involved. |

| Mounting HMRC Debt | Unresolved tax, VAT, PAYE, or National Insurance arrears causing HMRC to consider enforcement actions like winding-up petitions. |

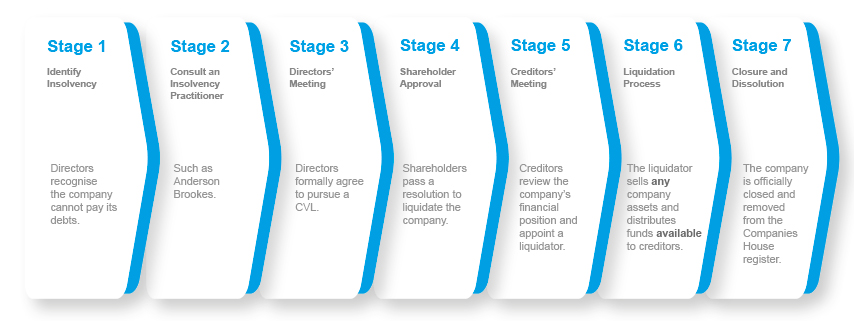

| Exploring Closure Options | You’re actively thinking about formally closing your insolvent company, needing advice on the correct procedure such as Creditors’ Voluntary Liquidation (CVL). |

| Debt Negotiations and Restructuring | You require structured debt repayment plans or formal insolvency arrangements like a Company Voluntary Arrangement (CVA). |

| Risk of Wrongful Trading | Directors risk personal liabilities or potential allegations of wrongful trading if they continue to operate the business whilst insolvent. |

Testimonials

Our clients praise our professionalism, reliability, and the exceptional support we provide during challenging times, helping thousands of company directors through insolvency, liquidation, and business debt solutions.

Why Early Advice Matters: A Practical Example

Consider a typical scenario: ABC Ltd experienced significant cash flow difficulties but delayed seeking advice. By the time they contacted an insolvency practitioner, creditor actions were already advanced, reducing their available options. Had ABC Ltd acted earlier, they might have arranged a more favourable repayment plan through a CVA, safeguarding key supplier relationships and preserving parts of the business.

Insolvency Myths: Debunking Misconceptions

| Myth | Reality |

| An IP immediately means business closure. | Many IP-led solutions aim for rescue or restructuring rather than closure. |

| Directors always face personal liability. | Early and compliant actions significantly reduce personal risks. |

| An IP means I lose control immediately. | IPs collaborate closely with directors to manage and guide through insolvency processes. |

Advantages of Engaging a Licensed Insolvency Practitioner

Working with an experienced Licensed Insolvency Practitioner like Rikki Burton ACA at Anderson Brookes ensures:

Legal Compliance: Expert handling of insolvency law to protect directors from personal liability.

Clear Strategy: Personalised advice on insolvency options tailored to your company’s needs.

Reduced Stress: Professional management of creditor negotiations, communication, and formal procedures.

Asset Maximisation: Careful handling and realisation of assets to improve outcomes for creditors and reduce director exposure.

Immediate Warning Signs: When to Act Now

Contact a Licensed IP immediately if:

-

You receive an HMRC winding-up petition

-

Creditor demands intensify and become overwhelming

-

Immediate cash flow solutions fail

-

Directors receive personal legal threats

Take Control with Expert Advice

If you’re facing any of these scenarios, Rikki Burton ACA and the experienced team at Anderson Brookes offer confidential, practical advice tailored to your needs. Act early to secure better outcomes and protect your interests.

Free Consultation Available:

Email: advice@andersonbrookes.co.uk

Phone: 0800 1804 935 (freephone)

Contact us now and confidently navigate through your business challenges.