Licensed IPs (Insolvency Practitioners): What You Need to Know

When your business faces financial difficulties, a Licensed Insolvency Practitioner (IP) can provide expert guidance to help you manage the complex options available and ensure compliance.

What is a Licensed IP?

A Licensed Insolvency Practitioner is a qualified professional authorised to act in relation to insolvent individuals, partnerships and companies. They’re the only professionals legally permitted to take formal insolvency appointments such as liquidations, administrations, and voluntary arrangements.

To become licensed, practitioners must:

- Complete extensive professional training

- Pass the Joint Insolvency Examination Board (JIEB) examinations

- Demonstrate significant practical experience

- Obtain a license from a recognised professional body such as the Insolvency Practitioners Association (IPA), Institute of Chartered Accountants (ICAEW), or Association of Chartered Certified Accountants (ACCA)

- Maintain ongoing professional development

- Hold professional indemnity insurance

IPs operate under strict regulatory oversight and must adhere to the Statements of Insolvency Practice (SIPs), which establish professional and ethical standards. Their work is regularly monitored by their licensing body to ensure compliance with these standards.

Unlike general business advisors or accountants, Licensed Insolvency Practitioners have specific legal powers granted under the Insolvency Act 1986 and subsequent legislation. These powers allow them to take control of company assets, investigate director conduct, and make legally binding decisions in formal insolvency procedures.

The role of an IP extends beyond simply closing down businesses. They’re trained to identify potential rescue options, negotiate with creditors, and where possible, help viable businesses continue trading through restructuring processes. For businesses that cannot be saved, the IP ensures an orderly wind-down that maximises returns to creditors while ensuring all legal requirements are met.

When selecting an IP, it’s advisable to look for someone with experience in your industry sector who can provide references or case studies demonstrating successful outcomes for similar businesses.

How Anderson Brookes Can Help

Anderson Brookes is a Licensed Insolvency Practitioner who work with businesses of all sizes facing financial challenges – though we specialise in SMEs. Our team provides confidential initial consultations to assess your situation, clear explanation of available options, guidance on the most appropriate solutions for your circumstances, and support throughout the entire insolvency process.

We worked with thousands of company directors and understand the stresses you may be under. As a result we have built our Licensed IPs to work within an efficient system – built around the challenges our clients face. This means, for example, we can often place a business into liquidation within 8 days from speaking with us.

Our overheads, focused and efficient solutions we have grown quickly and now from our Chorley base we work across England and Wales.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

How an IP Works with Businesses

When working with a business, an IP will review your financial position and business operations. They’ll explain the available options based on your specific circumstances and help you understand what each solution means for you. The IP handles communications with creditors, implements the chosen procedure, and ensures everything complies with legal requirements throughout the process.

Key Business Debt Solutions

Licensed Insolvency Practitioners can offer several formal solutions for limited companies:

Company Voluntary Arrangement (CVA)

A CVA is a formal payment plan with creditors that allows your business to continue trading. Directors remain in control of day-to-day operations while making agreed payments, typically over 3-5 years. This option works well for companies with viable business models but temporary cash flow problems.

Creditors’ Voluntary Liquidation (CVL)

When rescue isn’t viable, a CVL provides an orderly closure of an insolvent company. Assets are sold and proceeds distributed to creditors according to legal priorities. The company is dissolved after completion. This option brings a clean end to an unsustainable business.

Voluntary Liquidation Process – Working with a Licensed IP

Members’ Voluntary Liquidation (MVL)

For solvent companies that wish to close, an MVL offers a tax-efficient way of extracting company assets. Directors must sign a declaration of solvency. This process can provide access to Business Asset Disposal Relief, making it attractive for retirement or exit planning.

Administration

Administration provides breathing space from creditor pressure, aiming to rescue the company as a going concern. The administrator takes control of the company, which may result in restructuring or sale of the business. This option protects viable companies facing serious creditor pressure.

Implications for Directors

Working with a Licensed IP has several implications for company directors. Your conduct as a director will be reviewed as part of the process, which is standard procedure. If your company enters liquidation, you may be eligible for director redundancy payments.

It’s worth noting that personal guarantees remain enforceable despite company insolvency, so discussing these with your IP is important. Seeking early advice helps avoid potential wrongful trading allegations. If you have an overdrawn director’s loan account, this may need to be repaid as part of the insolvency process.

Getting Help

If your business is experiencing financial difficulties, seeking early advice from a Licensed Insolvency Practitioner like Anderson Brookes makes good sense. This ensures you understand all available option s and can make informed decisions before your situation worsens.

s and can make informed decisions before your situation worsens.

Most initial consultations are confidential and provided at no charge, giving you the opportunity to discuss your concerns without commitment. The sooner you speak with an IP, the more options you’ll have available to address your company’s financial challenges.

You may also like:

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

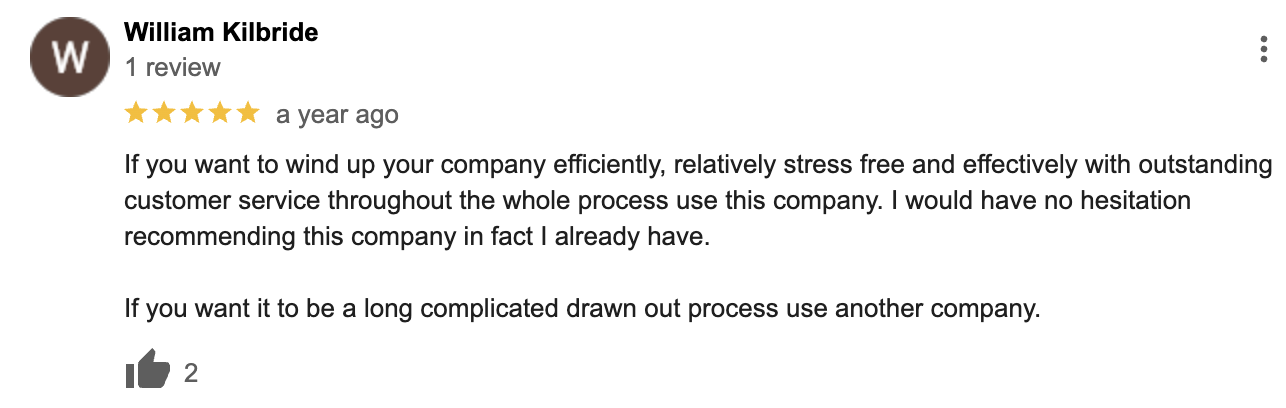

Google Reviews

&