Liquidation Advice for Festivals and Live Music Companies: Navigating Financial Challenges in the Events Industry

Winding Up Your Music Festival or Live Performance Enterprise

Experimental Gatherings and the Government’s Research Initiative

The government’s programme for researching live events has allowed some companies to plan with more confidence. However, not all businesses have been chosen to participate in these trial events. The delayed publication of results from this initiative has prolonged uncertainty for many in the festival and live music sector.

Lack of State-Backed Event Cover

The absence of government-supported insurance for cancelled events is causing ongoing financial strain. Companies face losses not only in terms of potential income but also from the substantial upfront costs required to organise an event.

Advice on Closing Down Music and Festival Businesses

If salvaging your enterprise is not feasible, it’s crucial to understand the liquidation process and its implications for you as a company director. A Creditors’ Voluntary Liquidation (CVL) is a formal procedure that must be overseen by authorised insolvency practitioners.

Opting for voluntary liquidation allows you to meet your legal obligations as a director and offers several advantages:

- You can select your own liquidator

- You can control the timing of the liquidation

- You may be eligible for redundancy pay as a director

Voluntary Liquidation Process – 7 Steps

Understanding Insolvent Liquidation

Liquidation involves winding down your company’s affairs under the supervision of an insolvency practitioner. Your business assets are sold at auction, with the proceeds used to repay creditors. As the company is insolvent, not all creditors will receive full repayment, and unsecured creditors rarely benefit from asset sales.

The process concludes with:

- Your company name being removed from the Companies House register

- Any remaining debts being written off

Potential Consequences for Company Directors

When your business becomes insolvent, your primary duty is to prioritise your creditors’ interests. Failure to do so could result in allegations of misconduct or wrongful trading following the liquidator’s investigations.

Risks of not acting promptly include:

- Disqualification as a director for up to 15 years

- Personal liability for additional debts incurred by creditors

Voluntary liquidation demonstrates your commitment to prioritising creditors and may make you eligible for director redundancy pay.

Redundancy Claims for Company Leaders

You may be able to claim redundancy pay as a director if:

- You’ve worked under an employment contract for at least two years

- You receive a regular salary through PAYE

The average claim for director redundancy is £9,000, which could provide valuable financial support during this difficult time.

To determine your eligibility for redundancy and explore your options, it’s advisable to seek professional advice. Many insolvency practitioners offer free initial consultations and can provide tailored guidance based on your specific circumstances.

Remember, while the closure of your festival or live music company can be challenging, understanding your rights and responsibilities can help you navigate the process more effectively.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Common Queries about Festival and Live Music Company Liquidation

What steps should you take when thinking about liquidating your festival or live music venture?

If you’re considering liquidating your festival or live music business, start by seeking professional advice from a licensed insolvency practitioner. They can assess your financial situation and explore alternatives to liquidation. Gather all financial records and documents to provide a clear picture of your company’s assets and liabilities. Communicate openly with stakeholders, including creditors and employees, about the situation. Consider potential legal obligations and contractual commitments that may affect the liquidation process.

What legal consequences might you face when winding up a live events company?

When liquidating a live events company, you must comply with UK insolvency laws and regulations. Directors have a duty to act in the best interests of creditors once insolvency becomes apparent. Failure to do so could result in personal liability for company debts. You may need to prove that you’ve taken reasonable steps to minimise losses to creditors. Be aware of potential investigations into your conduct as a director leading up to the liquidation.

How can creditors safeguard their interests during the liquidation of a live music business?

Creditors can protect their interests by:

- Promptly submitting claims to the liquidator

- Attending creditors’ meetings to stay informed and vote on important decisions

- Forming or joining a creditors’ committee to represent collective interests

- Providing any relevant information about the company’s assets or affairs to the liquidator

- Monitoring the liquidation process and questioning any concerns

What role does a liquidator play in winding up a live music enterprise?

A liquidator’s responsibilities include:

- Taking control of the company’s assets

- Investigating the company’s affairs and directors’ conduct

- Realising assets and distributing proceeds to creditors

- Dealing with creditor claims and queries

- Ensuring compliance with legal requirements throughout the liquidation

- Preparing reports on the liquidation process for creditors and regulatory bodies

How does liquidation impact employees of festivals and live music companies?

Employees are typically made redundant when a company enters liquidation. They become preferential creditors for certain claims, including:

- Unpaid wages (up to £800)

- Accrued holiday pay

- Statutory notice pay

- Redundancy pay

The government’s National Insurance Fund may cover some of these payments if the company cannot pay. Employees should submit claims to the liquidator and may need to apply to the Redundancy Payments Service for compensation.

What tax issues should you consider when liquidating a festival or live music company?

Key tax considerations include:

- Corporation Tax liabilities up to the date of liquidation

- VAT obligations and potential de-registration

- Capital Gains Tax on asset disposals

- Potential tax implications for directors and shareholders

- Ensuring all tax returns are up-to-date

- Dealing with any ongoing tax disputes or investigations

Consult with a tax professional to understand the specific tax implications for your company’s liquidation.

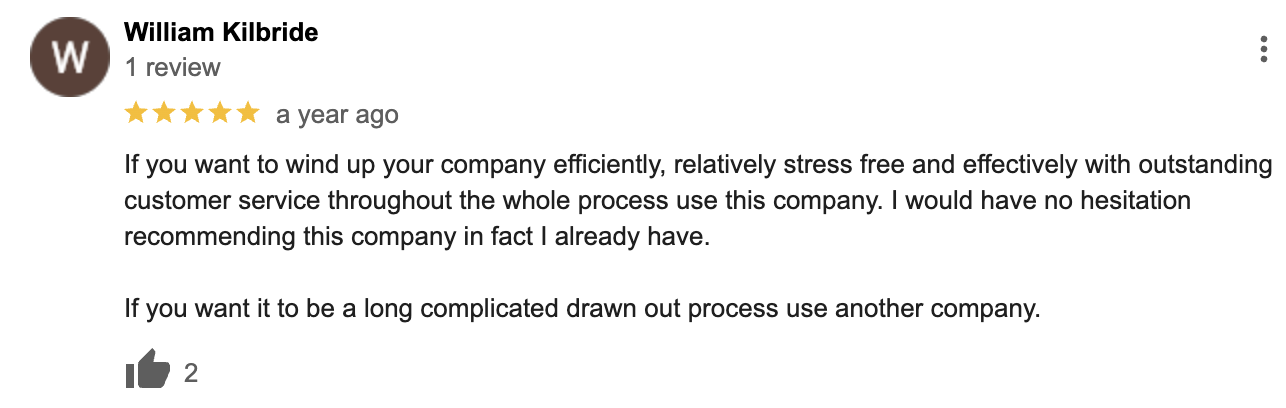

Liquidation – Google Reviews

&