“My pub needs to go into liquidation”

Pub Liquidation: An Overview

Expert Guidance for Pub Proprietors

If your pub is facing financial difficulties, seeking professional advice is crucial. A licensed insolvency practitioner can assess your situation and provide tailored guidance. They’ll explain your legal obligations to creditors and help you navigate the complex landscape of UK insolvency laws. Expert advice can also help you avoid potential pitfalls and ensure you’re taking appropriate action in challenging circumstances.

Understanding Creditors’ Voluntary Liquidation for Pubs

Creditors’ Voluntary Liquidation (CVL) is a formal process for limited companies that can no longer meet their financial obligations. It involves closing the pub permanently under the supervision of a licensed insolvency practitioner. The liquidator’s role includes:

- Realising company assets

- Distributing proceeds to creditors

- Removing the company from the Companies House register

- Investigating the reasons for business failure

CVL allows you to initiate the process and choose your liquidator, giving you more control over the situation. Anderson Brookes can place your pub into liquidation within 8 days!

Voluntary Liquidation Process for Pubs – 7 Steps

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Key Considerations for Pub Liquidation

When contemplating liquidation for your pub, several concerns may arise:

- Director liability: You could become personally liable for company debts in certain situations.

- Personal guarantees: Lenders may pursue you for outstanding debts if you’ve provided personal guarantees.

- Wrongful trading: Continuing to trade while insolvent can lead to serious consequences.

It’s essential to address these issues promptly and seek professional guidance to protect your interests.

Benefits of Voluntary Liquidation for Pub Owners

Opting for voluntary liquidation can offer several advantages:

- Greater control over the timing and process

- Fulfilment of legal obligations as a director

- Potential eligibility for redundancy pay

- Avoidance of compulsory liquidation by creditors

By taking proactive steps, you can manage the situation more effectively and potentially mitigate some of the negative impacts.

Claiming Redundancy as a Pub Owner

As a pub owner, you may be eligible for redundancy pay if:

- You’ve worked as an employee under a contract for at least two years

- You’ve worked a minimum of 16 hours per week in a practical role

The average claim for director redundancy is around £9,000. To determine your eligibility and pursue a claim, consult with an insolvency expert who can guide you through the process.

Next Steps for Pub Liquidation

If you’re considering liquidation for your pub, follow these steps:

- Seek professional advice immediately

- Explore potential rescue options (e.g., alternative funding, debt restructuring)

- Consider formal rescue procedures like Company Voluntary Arrangements (CVAs) or administration

- Investigate HMRC’s Time to Pay scheme for tax arrears

- If liquidation is necessary, choose a reputable insolvency practitioner

- Prepare all required documentation and information

- Cooperate fully with the liquidator throughout the process

Remember, acting swiftly and seeking expert guidance can help you navigate this challenging situation more effectively and ensure the best possible outcome for all parties involved.

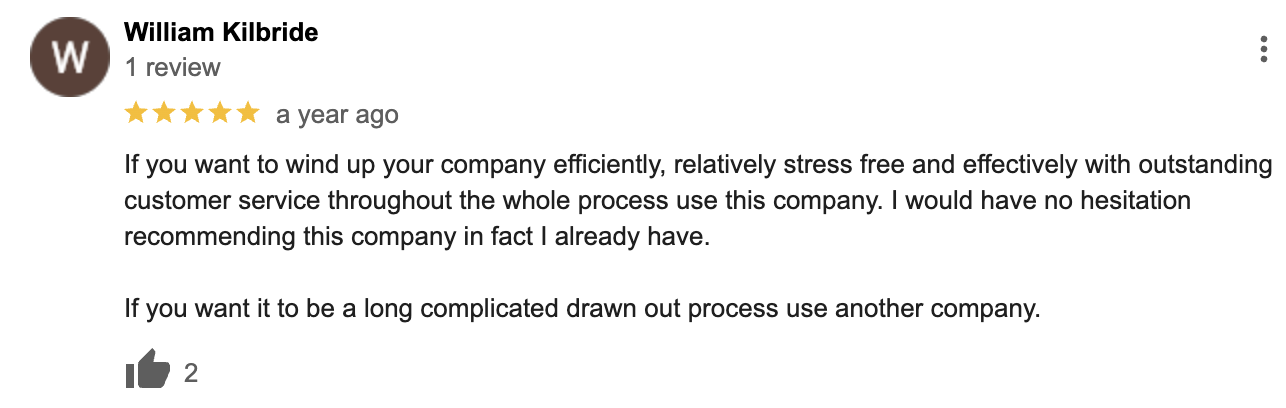

Liquidation – Google Reviews

&

Frequently Asked Questions

What happens to staff when a pub goes into liquidation?

When your pub enters liquidation, employees face redundancy. You must inform them promptly about the situation. Staff may be eligible for redundancy pay and other entitlements from the National Insurance Fund. The liquidator will assist with claims and provide necessary documentation.

How do you start the liquidation process for a pub?

To initiate liquidation:

- Consult an insolvency practitioner

- Hold a board meeting to pass a winding-up resolution

- Notify shareholders and call a general meeting

- Appoint a liquidator at the meeting

- File required documents with Companies House

The process typically takes 4-6 weeks to begin once you’ve decided to liquidate.

How long does pub liquidation usually take?

The duration varies based on the pub’s complexity:

- Simple cases: 6-12 months

- Complex cases: 12-24 months or longer

Factors affecting timeline:

- Asset value and ease of sale

- Number of creditors

- Legal disputes

- Tax complications

What are a pub owner’s legal duties during liquidation?

As a pub owner, your key legal responsibilities include:

- Cooperating fully with the liquidator

- Providing all financial records and company information

- Attending meetings and interviews as required

- Ceasing trading and not incurring new debts

- Avoiding preferential payments to specific creditors

- Refraining from using or disposing of company assets

Failure to meet these obligations may lead to personal liability or disqualification as a director.

How does liquidation affect pub creditors?

Creditors are impacted in several ways:

- Secured creditors have first claim on assets

- Preferential creditors (e.g., employees) are paid next

- Unsecured creditors receive any remaining funds

- Payments are made in order of priority set by law

- Creditors may receive only a portion of what they’re owed

- Some debts may be written off entirely

The liquidator will communicate with creditors throughout the process.

What consequences might a pub landlord face after liquidation?

Potential outcomes for pub landlords post-liquidation:

- Restriction on using similar business names

- Possible director disqualification (up to 15 years)

- Personal liability for certain debts if misconduct proven

- Difficulty obtaining future credit or directorships

- Potential tax implications

- Loss of personal assets if personal guarantees were given

Seek professional advice to understand your specific situation and minimise negative consequences.