What is Company Liquidation? A Plain English Guide

Anderson Brookes Insolvency Practitioners help directors close limited companies with debt quickly, legally and with expert guidance every step of the way.

Get Free Advice Today

What is Company Liquidation? A Plain English Guide

If your company is struggling with debts and no longer sustainable, liquidation might be the right step. It’s a formal process that allows a limited company to be closed down properly, under the supervision of a licensed insolvency practitioner.

Quick Answer

Company liquidation (also known as winding up) is a legal process that brings a limited company to an end. The company stops trading, its assets are sold, debts are paid (where possible), and it is removed from the Companies House register.

We have developed this guide based on the key questions we are asked each day by company directors who are looking to close their companies.

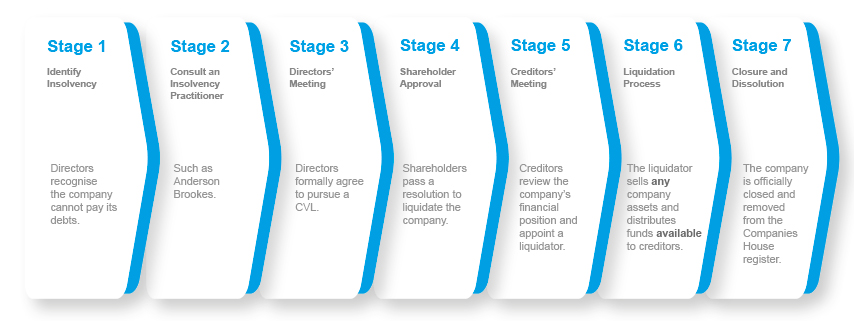

Voluntary Company Liquidation Example (CVL)

Key Facts for Business Owners

You don’t have to wait for a creditor to act – directors can choose to voluntarily liquidate an insolvent company.

There are three types of liquidation:

CVL (Creditors’ Voluntary Liquidation) – for insolvent companies, started by directors.

MVL (Members’ Voluntary Liquidation) – for solvent companies, typically used for retirement or tax-efficient exit.

Compulsory Liquidation – usually started by a creditor through a court order.

Once liquidated, the company no longer exists.

Any remaining funds not claimed before dissolution may pass to the Crown.

Need Advice?

If you’re considering closing your limited company or want to understand your options, speak with a licensed IP. At Anderson Brookes, we offer clear, regulated advice tailored to your situation.

Call 0800 1804 935 or email advice@andersonbrookes.co.uk for a free, confidential consultation.

Will I Still Have Responsibilities as a Director?

Yes – until the liquidator is appointed, directors must:

Preserve company assets

Avoid worsening creditor losses

Cooperate fully with the liquidator

Personal guarantees, overdrawn director loan accounts, or wrongful trading risks may apply – that’s why it’s important to seek regulated advice early.

What Happens in a Liquidation?

Once appointed, the licensed insolvency practitioner (IP) becomes the liquidator and takes over full control. They will:

Notify HMRC, Companies House and creditors

Value and sell company assets

Pay debts in legal order of priority

Investigate director conduct (standard)

Arrange for company dissolution

Company bank accounts may be frozen and access restricted – in some cases, you may need a court validation order to access funds.

Testimonials

Our clients praise our professionalism, reliability, and the exceptional support we provide during challenging times, helping thousands of company directors through insolvency, liquidation, and business debt solutions.

What Happens to Directors in a Company Liquidation?

Many directors worry about what liquidation means for them personally. Once a company enters liquidation, the licensed insolvency practitioner (IP) takes full control. From that point, directors are no longer responsible for managing the business, but they do remain involved in the early stages and may be required to answer questions about the company’s affairs.

You must provide accurate records, cooperate with the liquidator, and ensure any remaining assets or information are made available. This is a legal requirement and helps the process run smoothly.

If you’ve already read the section “Will I Still Have Responsibilities as a Director?”, you’ll understand that your duties continue right up until the liquidator is appointed.

Are Directors Liable for Company Debts?

In most cases, directors are not personally liable for company debts. However, there are exceptions. The most common risks include:

Personal guarantees: If you signed a guarantee for a business loan, lease or finance agreement, you may still be personally liable. This can include debts to HMRC — learn more about HMRC debts and liquidation.

Overdrawn director’s loan account: If you’ve taken more out of the business than you were entitled to, this is treated as an asset that must be repaid.

Misuse of Bounce Back Loans: If the loan wasn’t used correctly, or if the company was already insolvent when it was taken out, the liquidator is required to investigate.

Wrongful trading: Continuing to trade and take on credit when you knew the company couldn’t pay its debts may lead to claims against you.

These risks are not automatic. Each case is reviewed on its own merits, and we always provide honest, early advice so you can avoid unexpected issues.

Can a Director Claim Redundancy Pay?

Yes, you may be able to claim statutory redundancy if you are a director and meet certain criteria. This is one of the most misunderstood areas of liquidation. To qualify, you must:

Have worked for the company under a contract of employment (written or implied)

Have been paid a regular wage through PAYE

Worked a minimum of 16 hours per week in a practical role, not just an advisory one

Have been employed for at least two years

If you meet these conditions, you could claim redundancy, notice pay, and other statutory entitlements from the Redundancy Payments Service. These claims can, in some cases, help cover the cost of the liquidation itself.

Employees (including directors) are always paid in legal order of priority once the process begins. You can revisit the earlier section “What Happens in a Liquidation?” to understand how claims are handled.

Can I Start a New Company After Liquidation?

You are legally allowed to be a director of another limited company after liquidation, unless you are disqualified by the Insolvency Service. However, if you plan to trade using a similar name to your old company, special legal restrictions apply under the Insolvency Act.

These rules are designed to prevent confusion among creditors and customers, and you must follow the correct legal procedure. We explain all of this clearly during your consultation, and where necessary, we’ll support you with the formal steps required.

You can also read more in our guide to company strike-off and DS01 alternatives.

Why Directors Choose Anderson Brookes

With more than 25 years’ experience and thousands of directors helped, we’re trusted by business owners across the UK. You can speak directly with an expert insolvency practitioner and we’ll help you understand your options clearly and quickly. We specialise in working with small and medium businesses and we understand your perspective and priorities.

Ready to

Move On?

If you’re ready to close your company, stop creditor pressure, or just want to understand your next steps, we’re here to talk.

Call us now on 0800 1804 935 or request a call back - we’re here to help.

Will Liquidation Affect My Personal Credit?

Company liquidation does not appear on your personal credit file unless you have personally guaranteed a debt or owe money as an individual. However, some lenders and suppliers may review public insolvency registers and company directorship history, which may affect access to finance in the short term.

The company itself will be listed as liquidated at Companies House, and the process will be recorded in the Gazette.

More detail is available in our guide to liquidation timescales.

What If I’m Not Sure Liquidation Is Right?

Liquidation is one of several options. If your company is no longer trading and has no debts, strike-off might be simpler. If the business is struggling but could recover, you might consider a Company Voluntary Arrangement (CVA) or administration. We help you weigh up all the routes available and decide what’s best for you.

Call 0800 1804 935 or email advice@andersonbrookes.co.uk for a free, confidential consultation.

What Are the Wider Implications of Liquidation?

Closing a company is often seen as a last resort, but for many directors it provides a clean and lawful way to move forward. Once liquidation is complete:

The company ceases to exist and is removed from the register

Unpaid debts that aren’t personally guaranteed are written off

Creditors are notified and the pressure stops

You can make a fresh start, with proper legal guidance

If you’ve acted reasonably and kept records, there’s usually nothing to prevent you from running a new business in the future. However, if you’re planning to trade again in a similar sector, we’ll help ensure all the right checks are followed.

You can also explore how this works in more detail in our section on liquidation terminology.

Sectors We Support

We support company directors in every sector, from construction firms and logistics companies to pubs, cafés, restaurants, hotels, retailers and manufacturers. Our advice is always clear, confidential and shaped by real experience in your industry. Whether you’re dealing with unpaid tax, supplier pressure or falling income, our team understands the challenges and will guide you through the best next steps.