Types of Liquidation

CVL, MVL & Compulsory Liquidation – it can seem complicated…

Need Advice? Free Access to an IP

What Are Your Options?

If you’re running a limited company that’s facing closure, it’s important to understand the different types of liquidation. The right route will depend on whether your company is insolvent or still solvent.

Here’s a clear, plain English guide to the three main options:

Quick Comparison Table

| Type of Liquidation | When It’s Used | Who Starts It | Solvent or Insolvent? | Who’s Involved |

|---|---|---|---|---|

| Creditors’ Voluntary Liquidation (CVL) | Company can’t pay its debts | Company directors/shareholders | Insolvent | Licensed IP (chosen by company) |

| Members’ Voluntary Liquidation (MVL) | Company can pay all debts, but wants to close | Company shareholders | Solvent | Licensed IP |

| Compulsory Liquidation | Forced by a creditor through court | Creditors via court petition | Insolvent | Court + Official Receiver/IP |

1. Creditors’ Voluntary Liquidation (CVL)

Used when your company is insolvent and can’t pay its debts. Directors choose to close the business in an orderly way.

Most common form of liquidation

Assets sold to repay creditors

Directors appoint a licensed insolvency practitioner

Can reduce the risk of wrongful trading

You may be eligible for director redundancy

Best for: Insolvent companies with no future that want to close properly and avoid court.

2. Members’ Voluntary Liquidation (MVL)

Used when your company is solvent and can pay all debts – but you want to close it down, usually for tax efficiency.

-

Often used for retirement or restructuring

-

Tax benefits possible via Business Asset Disposal Relief

-

Directors make a statutory declaration of solvency

-

A licensed insolvency practitioner must manage the process

Best for: Solvent companies planning a clean, cost-effective closure.

3. Compulsory Liquidation

Used when your company is insolvent and a creditor forces closure through court action.

-

Begins with a winding-up petition from a creditor

-

Court appoints the Official Receiver or IP

-

You lose control of the company immediately

-

Directors must cooperate fully

-

Likely to involve more scrutiny and publicity

Best for: Situations where legal action has already begun or is unavoidable.

Unsure Which Route to Take?

It depends on:

Whether your business can pay its debts

Whether you’re acting voluntarily or under pressure

How quickly you need to act

Speak to a Licensed Insolvency Practitioner

The right advice at the right time can save stress, cost, and even protect your personal position.

Free, confidential advice from Anderson Brookes

📞 Call 0800 1804 935 or 📧 email advice@andersonbrookes.co.uk

Why Directors Choose Anderson Brookes

With more than 25 years’ experience and thousands of directors helped, we’re trusted by business owners across the UK. You can speak directly with an expert insolvency practitioner and we’ll help you understand your options clearly and quickly. We specialise in working with small and medium businesses and we understand your perspective and priorities.

Ready to

Move On?

If you’re ready to close your company, stop creditor pressure, or just want to understand your next steps, we’re here to talk.

Call us now on 0800 1804 935 or request a call back - we’re here to help.

Can you liquidate your limited company?

Frequently Asked Questions

Have a company in England or Wales? These are your limited company business debt, liquidation and insolvency questions answered.

Can I liquidate the company myself?

No. Only a Licensed Insolvency Practitioner can place a company into liquidation.

What are the advantages of liquidation?

Placing the company into liquidation will stop debt enforcement, including bailiff action. The directors are usually in control of the process and can choose the liquidator. In most cases, it can be completed within two weeks without needing to attend any formal meetings. Company debts are usually written off unless they are personally guaranteed. Directors who act responsibly can show they handled the company’s financial affairs properly.

Is liquidation the same as dissolving the company?

No. Only a Licensed Insolvency Practitioner can liquidate a company. A director can apply to dissolve a company through Companies House, but only if certain conditions are met. If the company is insolvent, it may be a criminal offence to apply for strike-off. Always take professional advice before doing this. If you think you might qualify for dissolution, call us and we’ll explain the process. See our Licensed vs Unregulated page.

What is compulsory liquidation?

This happens when a creditor applies to court to wind up a company due to non-payment of a debt over £750. If the court agrees, the company is placed into compulsory liquidation. This often leads to more problems for directors, who may find it harder to defend against accusations such as wrongful trading. It is usually better to start the process voluntarily. See Strike Off vs Voluntary Liquidation for more details.

How much will it cost to liquidate my company?

It depends on your situation. In most cases, the directors do not pay the costs personally. The liquidation is paid for using company assets. We are a small practice based in Bolton with low overheads, so we offer some of the most competitive fees in the UK. All costs will be confirmed in writing before we proceed. You may also be interested in CVL Costs.

What is a phoenix company?

This is a new limited company that starts after an old one has gone into liquidation. It allows the business to carry on with the profitable parts of the original company. There are strict rules about reusing a company name, so it’s important to get advice before going ahead. For further detail and more simple explanations of insolvency and liquidation terms see our Glossary.

What is a Members’ Voluntary Liquidation (MVL)?

An MVL is used when a company is still solvent and can repay all its debts. It may be the right option if directors want to retire or step away from the business. MVLs can offer tax benefits, but they must be handled by a Licensed Insolvency Practitioner. See all types of liquidations.

What is wrongful trading?

If a company is insolvent and directors carry on trading, they may be accused of wrongful trading. A director could be held personally liable if they knew, or should have known, that the company couldn’t avoid liquidation and did not act to reduce losses. Acting early helps reduce this risk.

Do you only offer formal insolvency advice?

No. Many businesses contact us who do not need formal insolvency procedures. We help explore all the options, including self-help and informal solutions. If formal action is needed, our Licensed Insolvency Practitioner can act for you directly.

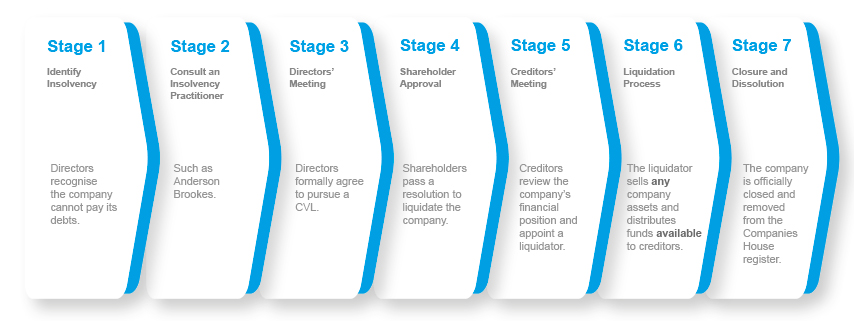

CVL Process - Most Common Route

Testimonials

Our clients praise our professionalism, reliability, and the exceptional support we provide during challenging times, helping thousands of company directors through insolvency, liquidation, and business debt solutions.