Managing Company Assets During Liquidation: A Comprehensive Guide for Maximising Value and Compliance

Understanding Liquidation and Its Implications

Liquidation marks the end of a company’s existence, involving the sale of assets and settlement of debts. It carries significant consequences for all stakeholders and follows strict legal procedures.

Definition of Company Liquidation

Company liquidation is the formal process of winding up a business’s affairs. It involves selling off assets, settling debts with creditors, and distributing any remaining funds to shareholders. The process is overseen by a licensed insolvency practitioner acting as the liquidator.

During liquidation, the company ceases trading and conducting business. All operations come to a halt, and employees are typically made redundant. The liquidator takes control of the company’s assets and bank accounts, managing them for the benefit of creditors.

Types of Liquidation: Voluntary vs. Compulsory

Voluntary liquidation occurs when shareholders decide to wind up the company. There are two types:

- Members’ Voluntary Liquidation (MVL): For solvent companies

- Creditors’ Voluntary Liquidation (CVL): For insolvent companies

Compulsory liquidation happens when creditors petition the court to wind up a company that can’t pay its debts. This process is often initiated after failed attempts to recover money owed.

In both types, the liquidator’s role is to realise assets, investigate the company’s affairs, and distribute proceeds to creditors according to a strict order of priority.

Legal Framework Governing Liquidation in the UK

The Insolvency Act 1986 and the Companies Act 2006 form the primary legal basis for liquidation in the UK. These laws outline the procedures, rights, and responsibilities of all parties involved.

Key aspects of the legal framework include:

- Rules for appointing liquidators

- Powers and duties of liquidators

- Rights of creditors and shareholders

- Order of priority for distributing assets

- Reporting requirements and timelines

The framework aims to ensure a fair and orderly process, protecting the interests of creditors while allowing for the efficient closure of non-viable businesses. It also sets out provisions for investigating potential wrongdoing by directors and recovering assets where appropriate.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

The Role of Assets in the Liquidation Process

In a company liquidation assets are identified, valued, and realised to repay creditors and settle outstanding debts. Understanding how assets are handled is essential for all parties involved in the liquidation process. Business directors need to ensure transparency and we guide you through this process.

Identifying Company Assets Subject to Liquidation

When a company enters liquidation, all assets must be accounted for. These include tangible assets like property, equipment, and inventory, as well as intangible assets such as intellectual property and contracts. The liquidator catalogues these assets meticulously.

Cash and bank accounts are immediately frozen and transferred to the liquidator’s control. Vehicles, machinery, and office equipment are assessed for their resale value. Stock is inventoried and prepared for sale.

Receivables and outstanding invoices are also considered assets. The liquidator will attempt to collect these debts to maximise the funds available for creditors.

Valuation of Assets Prior to Liquidation

Accurate asset valuation is critical in the liquidation process. Professional appraisers may be engaged to provide fair market valuations for significant assets. This ensures transparency and helps maximise returns for creditors.

Property valuations consider current market conditions and any encumbrances. Equipment and machinery are valued based on age, condition, and market demand. For specialised assets, industry experts may be consulted.

Intangible assets, such as patents or trademarks, require careful assessment. Their value can vary significantly depending on market conditions and potential buyers.

The liquidator must also consider any charges or liens against assets, as these can affect their realisable value.

Methods of Asset Realisation

Asset realisation aims to convert company assets into cash as efficiently as possible. The method chosen depends on the nature of the asset and market conditions.

Auction: Often used for equipment, vehicles, and inventory. It can be an effective way to sell assets quickly.

Private Treaty Sale: Suitable for high-value assets or those with a limited market. The liquidator negotiates directly with potential buyers.

Going Concern Sale: If possible, selling the business as a whole can yield better returns and preserve jobs.

For specialised assets, the liquidator may engage industry-specific brokers to reach potential buyers. Online platforms are increasingly used to expand the pool of potential purchasers.

The timing of asset sales is an important one to consider. The liquidator must balance the need for quick realisation with achieving the best possible price for creditors.

Distribution of Proceeds from Liquidated Assets

When a company undergoes liquidation, the funds generated from selling assets are distributed to creditors and shareholders in a specific order. This process ensures fair treatment of all parties involved while adhering to legal requirements.

Order of Priority Among Creditors

Secured creditors take precedence in the distribution of proceeds. These typically include banks and commercial finance providers with registered charges against company assets. They receive payment first from the sale of the specific assets they hold as security.

Next in line are preferential creditors, such as employees owed wages and pension contributions. The liquidator then sets aside a portion of the remaining funds, known as the ‘prescribed part’, for unsecured creditors.

Unsecured creditors, including suppliers and HMRC, receive a share of the prescribed part. If any funds remain after paying these creditors, they are distributed among floating charge holders.

Impact on Shareholders

Shareholders are last in the distribution hierarchy and only receive funds if all creditors have been paid in full. In most liquidations, shareholders do not receive any return on their investment.

If there are sufficient funds to pay all creditors, the remaining assets are distributed among shareholders according to their rights and the number of shares they hold. Preference shareholders typically receive payment before ordinary shareholders.

The liquidator calculates the amount due to each shareholder and issues a final dividend. This marks the end of the liquidation process and the company’s dissolution.

You may also be interested in our article on the implications of ‘pre-selling’ assets.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Legal and Ethical Considerations

As a director, you have a duty to act in the best interests of creditors once insolvency becomes apparent. You must provide all relevant financial information and company records to the liquidator. Cooperate fully with the liquidation process and avoid any actions that could be seen as preferential treatment of certain creditors.

You’re required to attend meetings with the liquidator and creditors when requested. Failure to fulfil these obligations can result in personal liability or disqualification from acting as a director in the future. Be prepared to explain any transactions or decisions made in the lead-up to liquidation.

Avoiding Wrongful Trading and Asset Misappropriation

Wrongful trading occurs when you continue to trade whilst knowing the company is insolvent. To avoid this, cease trading immediately once insolvency is clear. Don’t take on new debts or make payments that could be deemed preferential.

Misappropriation of assets is a serious offence. All company property must be accounted for and handed over to the liquidator. This includes:

- Physical assets

- Intellectual property

- Customer lists

- Financial records

Don’t attempt to transfer assets to personal ownership or other entities. Such actions can be reversed by the courts and may lead to criminal charges. Seek professional advice if you’re unsure about the proper handling of any company assets during liquidation.

Challenges In Asset Liquidation

Asset liquidation during company dissolution can present significant hurdles. Liquidators often face complex issues that require careful navigation to maximise value for creditors whilst adhering to legal requirements.

Dealing With Onerous Assets

Onerous assets can pose substantial difficulties during liquidation. These assets may include unprofitable contracts, leases with unfavourable terms, or properties with environmental liabilities. Liquidators must assess whether retaining these assets will benefit creditors or if disclaiming them is more prudent.

Identifying onerous assets early by reviewing all contracts and leases to determine their impact on the liquidation process. In some cases, negotiating with counterparties to terminate agreements may be necessary.

Environmental liabilities require special attention. Properties with contamination issues can be particularly challenging to sell. You might need to engage environmental specialists to assess risks and potential remediation costs.

Addressing Disputes Over Asset Ownership

Ownership disputes can significantly complicate asset liquidation. These conflicts may arise from unclear documentation, competing claims, or complex corporate structures.

To mitigate these challenges, you should:

- Conduct thorough due diligence on all company assets

- Review ownership documentation meticulously

- Engage legal experts to resolve complex ownership issues

- Communicate transparently with all stakeholders

In cases of disputed ownership, you may need to seek court intervention. This can lead to delays and increased costs, potentially reducing the overall value available for distribution to creditors.

Resolving these disputes promptly is essential to prevent asset depreciation and maintain creditor confidence in the liquidation process.

How Anderson Brookes Can Assist

Anderson Brookes offers comprehensive liquidation services to guide businesses through the complex process of closing down and managing assets. Our team of experts provides tailored solutions to ensure legal compliance and maximise financial outcomes for companies in liquidation.

Expertise in Asset Valuation and Realisation

Anderson Brookes employs skilled professionals who specialise in accurate asset valuation. We conduct thorough assessments of your company’s assets, including property, equipment, and inventory. This precise valuation ensures you receive fair market value during liquidation.

We develop strategic plans to realise assets efficiently – identifying channels for asset disposal, whether through auctions, private sales, or specialised markets. This approach aims to maximise returns for creditors and shareholders.

Anderson Brookes also manages the logistics of asset disposal. We handle the removal and sale of physical assets, ensuring a smooth and timely process. Over the last 20 years we have built a network of buyers and industry contacts often leads to quicker sales at competitive prices.

Guidance on Legal Compliance During Liquidation

The legal aspects of liquidation can be daunting. We provide expert guidance to ensure you meet all statutory requirements and our team help you understand your legal obligations as a director during the liquidation process. This includes the necessary filings and documentation, preparing and submitting required forms to Companies House and HMRC.

Anderson Brookes advises on proper asset distribution in accordance with UK insolvency laws. We help prioritise creditor claims and ensure fair treatment of all parties involved and our guidance and approach protects you from potential legal challenges post-liquidation.

Free Initial Consultation to Discuss Your Options

We offer a no-obligation initial consultation to discuss your company’s situation. During this meeting, our long-standing and trusted team, including licensed IPs, assess your financial position and explain available options. This allows you to make an informed decision about proceeding with liquidation.

We provide a clear overview of the liquidation process and its implications. You’ll gain insights into potential outcomes, timelines, and costs associated with different liquidation routes. This transparency helps you prepare for the journey ahead.

The consultation also covers potential alternatives to liquidation. For example, we may suggest restructuring options or debt management solutions if appropriate. Our goal is to find the best path forward for your specific circumstances – ensuring compliance throughout!

Frequently Asked Questions

Company liquidation involves complex legal and financial processes. Directors face specific obligations and consequences when winding up a business. Asset distribution follows strict protocols to ensure fairness to creditors.

What are the legal obligations of a director when a company is being liquidated?

Directors must cooperate fully with the appointed liquidator. You’re required to provide all company books, records and assets. Failing to do so can result in personal liability or disqualification.

You must also avoid any actions that could be seen as wrongful or fraudulent trading. This includes continuing to trade when you know the company is insolvent.

Is it possible for a former director of a liquidated company to serve as a director again?

Yes, in most cases you can serve as a director again after liquidation. However, if you’ve been disqualified due to misconduct, you’ll be barred from directorship for a specified period.

The length of disqualification typically ranges from 2 to 15 years, depending on the severity of the misconduct.

What are the common grounds for a company’s liquidation?

Insolvency is the primary reason for liquidation. This occurs when a company cannot pay its debts as they fall due or when liabilities exceed assets.

Other grounds include:

- Irretrievable breakdown in shareholder relationships

- Achieving the company’s purpose

- Court order due to public interest concerns

Could you outline the step-by-step process involved in liquidating a company?

- Determine insolvency and decide on liquidation

- Appoint a licensed insolvency practitioner

- Hold meetings with shareholders and creditors

- File necessary documents with Companies House

- Liquidator takes control of assets and settles debts

- Final accounts prepared and company dissolved

How does liquidation affect a director’s ability to secure a mortgage?

Liquidation can impact your credit score, making it more challenging to secure a mortgage. Lenders may view you as a higher risk applicant.

You might face stricter lending criteria or higher interest rates. However, the impact lessens over time, especially if you’ve managed your personal finances well.

What is the protocol for distributing a company’s assets during liquidation?

Asset distribution follows a strict order of priority:

- Secured creditors

- Preferential creditors (e.g., employees)

- Unsecured creditors

- Shareholders (if any funds remain)

The liquidator is responsible for selling assets and distributing proceeds fairly amongst creditors. They must adhere to legal requirements throughout this process.

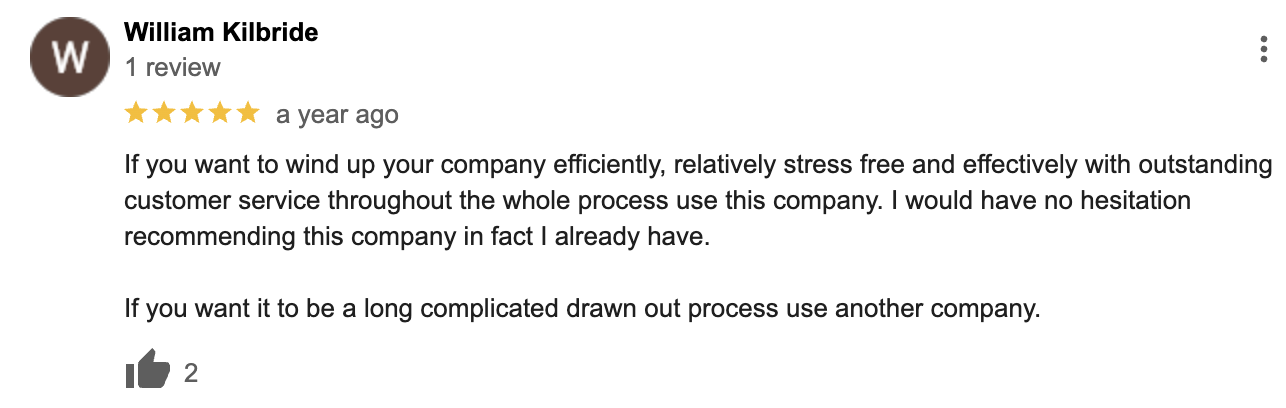

Liquidation Google Reviews

&