Pre-Pack Liquidation and Administration: A Complete Guide for UK Businesses – Navigating Corporate Recovery Options in 2025

Understanding Pre-Pack Solutions In Insolvency

Pre-pack solutions offer UK businesses a structured approach to handle insolvency while preserving value and maintaining operations. These solutions enable the sale of business assets to be arranged before formal proceedings begin. A pre-pack administration is typically for a ‘larger’ business, however, the term is often used in the UK to refer to the process of closing down a company – whether that is through a liquidation (such as a CVL) or administration.

What Is Pre-Pack Liquidation?

Pre-pack liquidation involves arranging the sale of company assets before entering voluntary liquidation. The process starts with a licensed insolvency practitioner valuing the business assets. A sale agreement is negotiated with potential buyers, which can include the existing directors through a new company structure. The formal liquidation begins once terms are agreed, and the sale executes immediately after the liquidator’s appointment. This approach helps maximise asset values and can protect jobs while ensuring a smoother transition for customers and suppliers.

What Is Pre-Pack Administration?

Pre-pack administration allows for the sale of a struggling company’s business or assets immediately upon the administrator’s appointment. The sale terms are arranged discretely beforehand with qualified buyers.

The administrator must ensure the sale represents the best outcome for creditors. They will typically market the business or obtain independent valuations to support their decision. This process can preserve the company’s value, protect employment, and maintain essential business relationships.

The sale can complete within days of the administrator’s appointment, minimising disruption to operations.

Key Differences: Pre-Pack Liquidation Vs. Pre-Pack Administration

Control and Management:

- Administration: Directors can retain control through purchase

- Liquidation: Directors typically lose control completely

Business Continuity:

- Administration: Trading usually continues uninterrupted

- Liquidation: Trading often ceases before asset sale

Time Frame:

- Administration: Quick completion, often within days

- Liquidation: Longer process due to statutory requirements

Cost Implications:

- Administration: Higher professional fees

- Liquidation: Generally lower costs involved

Asset Values:

- Administration: Better preservation of asset values

- Liquidation: May result in reduced asset values

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

The Pre-Pack Administration Process Explained

A pre-pack administration involves careful planning, professional guidance, and strict adherence to legal requirements. The process centres on preserving business value while protecting creditor interests through a structured sale.

Step 1 – Assessing Business Viability

You must first engage a licensed insolvency practitioner to evaluate your company’s financial position. The IP will review your books, assets, and operations to determine if a pre-pack offers the best solution.

Your board of directors needs to pass a formal resolution to explore pre-pack administration as an option. The IP will examine alternatives like CVAs, refinancing, or traditional administration.

Key assessments include:

- Current and projected cash flow

- Asset valuations

- Outstanding creditor obligations

- Potential buyer interest

- Employee considerations

Step 2 – Preparing For A Pre-Pack Sale

The IP begins confidential marketing of your business while maintaining normal operations. Professional valuations of assets must be obtained from independent specialists.

You’ll need to prepare:

- Detailed financial statements

- Asset registers

- Customer contracts

- Employee information

- Intellectual property documentation

Potential buyers are identified and vetted through a structured process. Your IP will manage negotiations to secure the best possible terms.

Step 3 – Securing The Best Outcome For Creditors

The IP must demonstrate that a pre-pack sale offers better returns than other insolvency options. They’ll document all decisions and valuations in compliance with SIP 16 regulations.

Creditors receive formal notification once terms are agreed. While they cannot block the sale, the IP must justify the proposed strategy.

The administrator will:

- Compare expected returns across different scenarios

- Document marketing efforts

- Verify buyer independence

- Calculate estimated dividend payments

Step 4 – Completing The Sale And Transitioning Operations

Upon appointment, the administrator executes the pre-arranged sale agreement. Assets transfer to the new company immediately to maintain business continuity.

Essential tasks include:

- Transferring employee contracts (TUPE regulations)

- Novating key supplier agreements

- Securing premises

- Migrating IT systems

- Communicating with stakeholders

The old company remains in administration while the IP addresses creditor claims. You must ensure all legal requirements are met during the transition to prevent any interruption to trading.

Advantages And Disadvantages Of Pre-Pack Insolvency Solutions

Pre-pack sales offer both significant benefits and notable risks that require careful consideration before proceeding with this insolvency solution.

Benefits Of A Pre-Pack Sale

A pre-pack sale enables your business to continue operating without interruption, preserving valuable customer relationships and contracts. Your employees’ jobs remain protected through TUPE regulations, maintaining workforce stability.

The swift nature of pre-pack deals minimises asset depreciation and helps preserve brand value. Your company can often retain its existing suppliers and trading relationships.

The streamlined process typically costs less than traditional administration, reducing professional fees and administrative expenses.

Pre-pack sales frequently achieve better returns for creditors compared to standard liquidation, as assets are sold as a functional business rather than at auction prices.

Risks And Ethical Considerations

Creditors might view your pre-pack sale negatively, particularly if the business is sold back to existing directors. This can damage commercial relationships and your business reputation.

The process faces scrutiny for its perceived lack of transparency. Your company’s administrators must thoroughly document all decisions to demonstrate fair value was achieved.

Connected-party sales trigger mandatory independent evaluations under recent regulations, adding time and cost to the process.

Directors’ conduct during the pre-pack period faces investigation, and you must ensure all actions meet strict regulatory requirements.

The new business might struggle to secure credit terms with suppliers who experienced losses in the previous company.

Who Can Buy A Business Through A Pre-Pack Administration?

Pre-pack administration sales can be completed with both connected parties, such as existing directors, and independent third-party buyers, provided they meet specific criteria and follow regulatory requirements.

Sale To Existing Directors Or Management

Connected parties, including current directors and shareholders, can purchase their company’s assets through a pre-pack administration. You must demonstrate that the proposed purchase represents the best value for creditors.

The purchase price must reflect fair market value, supported by independent valuations. Directors need to provide clear evidence of available funding for the purchase.

Since 2021, connected party sales face additional scrutiny. You must obtain an independent evaluator’s report or seek creditor approval before proceeding with the purchase.

Third-Party Buyers In A Pre-Pack Sale

Independent buyers must prove they have sufficient funds to complete the purchase and maintain business operations. The administrator will conduct due diligence to verify your financial position.

You’ll need to demonstrate your capability to operate the business successfully. This includes having relevant industry experience or a strong management team.

Third-party buyers often receive preferential consideration as they typically face less scrutiny than connected parties. You might need to sign confidentiality agreements during negotiations.

The administrator must ensure the sale price maximises returns for creditors, regardless of the buyer’s identity.

Legal and Regulatory Framework Governing Pre-Pack Administration

Pre-pack administrations in the UK operate under strict legal oversight and professional guidelines designed to protect creditor interests and maintain transparency throughout the process.

Compliance With The Enterprise Act 2002

The Enterprise Act 2002 establishes the fundamental legal structure for pre-pack administrations in the UK. This legislation sets out the primary objective of administration: to rescue the company as a going concern.

The Act requires administrators to be licensed insolvency practitioners and mandates they act in the best interests of all creditors collectively.

Key compliance requirements include:

- Notification to creditors within 7 days of appointment

- Detailed proposals submitted within 8 weeks

- Regular progress reports every 6 months

The Role Of Statement Of Insolvency Practice (SIP) 16

SIP 16 provides essential guidance for insolvency practitioners managing pre-pack sales. The statement demands comprehensive disclosure of all aspects of the pre-pack process.

Required disclosures include:

- Marketing activities undertaken

- Valuations obtained

- Alternative options considered

- Details of connected party transactions

- Pricing justification

Your administrator must provide this information to creditors within 7 days of the sale completion.

Ethical Considerations In Pre-Pack Insolvency

Professional ethics play a vital role in pre-pack administrations. Administrators must demonstrate independence and avoid conflicts of interest throughout the process.

The Pre-Pack Pool offers voluntary independent scrutiny for connected party transactions. This review enhances transparency and creditor confidence.

Key ethical obligations:

- Fair valuation of assets

- Proper marketing of the business

- Equal treatment of creditors

- Clear documentation of decisions

- Transparent communication with stakeholders

The Role Of Insolvency Practitioners In Pre-Pack Administration

Licensed Insolvency Practitioners serve as administrators who oversee the entire pre-pack process while maintaining strict compliance with UK insolvency laws and protecting stakeholder interests. These qualified professionals evaluate, negotiate, and execute the pre-arranged sale of business assets.

This is what we do at Anderson Brookes. We have been in business since 2001, specialise in corporate insolvency work and employ our own in-house Insolvency Practitioner (licensed by the ICAEW). Working with thousands of company directors – we are happy to offer free advice and discuss the options available to you. With our specific niche and focus we can offer quick, compliant and low cost solutions – for example, placing a company into liquidation within 8 days.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 935 our freephone number (including from mobiles).

Duties And Responsibilities Of An Administrator

Your appointed Insolvency Practitioner must conduct thorough due diligence on the proposed pre-pack sale and assess its viability. They evaluate the business assets, verify the fairness of the proposed purchase price, and scrutinise potential buyers.

The administrator handles negotiations between all involved parties, including creditors, directors, and potential purchasers. They ensure proper documentation of all transactions and maintain detailed records.

Key responsibilities include:

- Validating that a pre-pack sale offers the best returns for creditors

- Arranging independent valuations of business assets

- Managing the formal administration process

- Ensuring compliance with SIP 16 regulations

How Insolvency Practitioners Protect The Interests Of Creditors

Your Insolvency Practitioner must act impartially and balance the interests of all creditors. They scrutinise any proposed sale to connected parties with heightened diligence.

The administrator provides detailed reports to creditors explaining why a pre-pack was chosen and demonstrating that the best possible price was achieved for assets.

They work to maximise returns through:

- Obtaining multiple independent valuations

- Marketing assets where appropriate

- Negotiating optimal terms with purchasers

- Investigating any potential wrongful trading

The administrator maintains transparent communication with creditors throughout the process and addresses any concerns raised about the pre-pack arrangement.

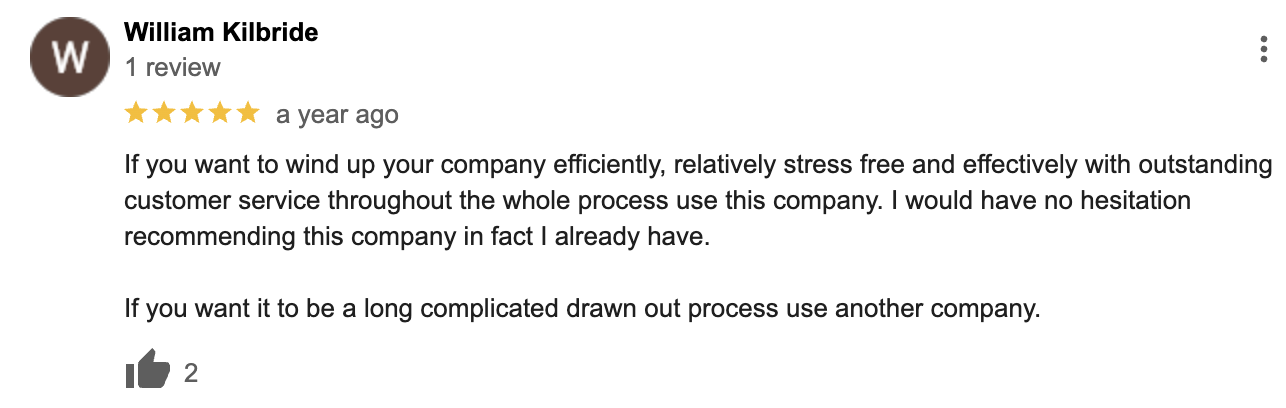

‘Pre-Pack’ Google Reviews

&

Alternative Insolvency Solutions To Pre-Pack Administration

When facing financial difficulties, UK businesses can choose from several formal insolvency procedures that offer different advantages based on their specific circumstances and goals.

Creditors’ Voluntary Liquidation (CVL)

A CVL provides an orderly way to close your business whilst ensuring fair treatment of creditors. You maintain control by initiating the process voluntarily rather than waiting for creditors to force the issue.

The liquidator will sell your company’s assets at market value and distribute the proceeds to creditors according to the statutory order of priority.

CVL offers a clean break and protection from personal liability, provided you’ve acted properly as a director. The process typically takes 6-12 months to complete.

Company Voluntary Arrangement (CVA)

A CVA enables you to continue trading whilst restructuring your debts through a formal agreement with creditors. You’ll propose a payment plan, typically lasting 3-5 years.

Your company retains control of its assets and operations under a CVA. The arrangement must be approved by 75% of creditors by value.

Key benefits of a CVA:

- Protection from creditor pressure

- Ability to maintain supplier relationships

- Preservation of business value

- More flexible than administration

Administration Without A Pre-Pack Sale

Standard administration provides breathing space to restructure your business without an immediate asset sale. An administrator takes control to protect the company from creditor actions.

The administrator has 8 weeks to create a proposal outlining the strategy for achieving the administration’s objectives.

This option works well when your business needs time to:

- Restructure operations

- Secure new investment

- Negotiate with creditors

- Complete ongoing contracts

The moratorium period gives you valuable time to explore rescue options whilst protecting the business from legal actions.

Frequently Asked Questions

Pre-pack administration procedures involve complex legal requirements, creditor considerations, and specific impacts on various stakeholders within UK businesses. These elements shape the rights, responsibilities, and outcomes for all parties involved.

How does pre-pack administration affect the rights of employees within a UK business?

Employment contracts automatically transfer to the new company under TUPE regulations, preserving existing terms and conditions of employment.

Your position and rights remain protected during the transfer process, including your length of service, salary, and other contractual benefits.

If redundancies become necessary, you maintain your right to statutory redundancy pay and the ability to claim from the National Insurance Fund.

What distinguishes a pre-pack administration from a typical administration process in the UK?

A pre-pack administration involves arranging the sale of company assets before entering administration, with the transaction completing immediately after appointment.

The speed of pre-pack sales helps preserve business value and maintains operational continuity, unlike traditional administration where the business continues trading while seeking a buyer.

The administrator must provide detailed justification for choosing a pre-pack sale over other options.

What are the potential drawbacks for a company entering pre-pack administration?

Suppliers might impose stricter payment terms or require personal guarantees when dealing with the new company.

The process can damage relationships with creditors who may feel excluded from the decision-making process.

Your company’s reputation might face scrutiny, as some stakeholders view pre-packs with suspicion.

What implications does pre-pack administration have for unsecured creditors in the UK?

Unsecured creditors often receive minimal returns from the pre-pack sale proceeds.

You lack voting rights on the proposed sale, though administrators must explain their reasoning within seven days.

The new company can choose which supplier relationships to maintain going forward.

How does the pre-pack administration process impact the position of HMRC as a creditor?

HMRC maintains its position as a preferential creditor for certain tax debts, including VAT and PAYE.

Your tax liabilities from the old company remain subject to normal insolvency rules and rankings.

The new company starts with a clean slate regarding tax obligations but faces close scrutiny from HMRC.

In what ways do liquidation and pre-pack administration differ under UK insolvency law?

Pre-pack administration aims to preserve business value and continue trading, while liquidation focuses on closing the company and selling assets.

Your business can continue operating through a pre-pack, whereas liquidation means ceasing all operations permanently.

Employee contracts can transfer in a pre-pack, but liquidation typically results in immediate redundancies.