Shutting Up Shop: What It Means and What to Do If Your Business Is Closing

If you’re searching for information on “shutting up shop,” chances are you’re considering closing your business or facing financial difficulties. In the UK, businesses cease trading for various reasons, including financial struggles, market changes, or simply a planned exit. But if financial distress is driving the closure, it’s essential to understand the options available and the correct legal processes to follow.

What Does ‘Shutting Up Shop’ Mean?

The phrase “shutting up shop” is commonly used to describe a business closing down. However, it doesn’t specify the reason for closure. Some businesses close voluntarily due to retirement or restructuring, while others are forced to close due to insolvency. Understanding the difference is crucial, as the legal and financial implications vary significantly.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Closing a Business: Understanding Your Options

A business owner facing closure has several routes available. If your company is financially stable but you wish to close, you can go through a Members’ Voluntary Liquidation (MVL) or apply for a strike off via Companies House if there are no outstanding debts. Selling the business is another option if it has viable assets and goodwill.

However, if the company has outstanding debts and cannot pay them, insolvency options such as Creditors’ Voluntary Liquidation (CVL), compulsory liquidation, or administration need to be considered. Each option has legal and financial consequences, and professional guidance is crucial to ensure compliance and the best outcome.

Which Option Is Right for Your Business?

The right closure route depends on your company’s financial position and long-term goals. Here’s how each process works:

Voluntary Strike Off (DS01 Form)

For businesses that are dormant or have no outstanding debts, voluntary strike off is a cost-effective way to close the company. Directors submit a DS01 form to Companies House, requesting the company’s removal from the register.

However, before taking this step, ensure the business has no debts, as creditors can object to the strike off. Any funds left in the business’s bank account at the time of strike-off will be transferred to the Crown, meaning directors and shareholders lose access to the money. Additionally, closing the company will erase its trading history, making it difficult to reference in the future.

Members’ Voluntary Liquidation (MVL)

An MVL is an option for solvent businesses where directors wish to close the company and distribute assets to shareholders in a tax-efficient manner. It is often used when directors are retiring or restructuring their business interests.

Key requirements for an MVL:

- The company must be solvent (able to pay all outstanding debts).

- A declaration of solvency must be signed by the directors.

- A licensed insolvency practitioner must oversee the process.

MVLs are often preferred for tax efficiency, as distributions to shareholders can be treated as capital gains rather than income, allowing directors to benefit from Entrepreneurs’ Relief (Business Asset Disposal Relief).

Creditors’ Voluntary Liquidation (CVL)

If a company is insolvent and unable to pay its debts, a CVL allows directors to voluntarily close the business while ensuring creditors receive as much repayment as possible.

The CVL process involves:

- Directors making the decision to liquidate due to insolvency.

- Appointing a licensed insolvency practitioner to manage the process.

- Informing creditors and employees about the liquidation.

- Selling company assets to repay debts.

- Dissolving the company once the process is complete.

A CVL provides legal protection to directors and ensures compliance with insolvency laws. Directors who continue to trade while knowingly insolvent risk wrongful trading claims, which can result in personal liability for debts.

Voluntary Liquidation Process – Quick Example

Administration

Administration is a formal insolvency process designed to rescue a struggling business rather than close it immediately. A licensed insolvency practitioner is appointed as the administrator, taking control of the company to determine whether it can be restructured, sold, or liquidated.

Administration can provide:

- Protection from creditors through a moratorium (temporary freeze on legal actions).

- A chance to sell the business as a going concern.

- An opportunity to restructure debt and continue trading.

If a viable business rescue isn’t possible, the company will proceed to CVL or dissolution.

How Anderson Brookes Can Help

Closing a business can be stressful, especially when facing mounting debts, legal action from creditors, or pressure from HMRC. Anderson Brookes employs an in-house Licensed Insolvency Practitioner, which allows us to handle insolvency cases swiftly and professionally. Our team can place a company into liquidation within 8 days, ensuring legal compliance while protecting directors from unnecessary risks.

We work closely with business owners to provide tailored solutions. Whether you need to wind down a solvent company, deal with creditor pressure, or explore business recovery options, our experts will guide you through the process step by step. We ensure directors understand their obligations and help them achieve the best outcome possible while avoiding unnecessary legal complications.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

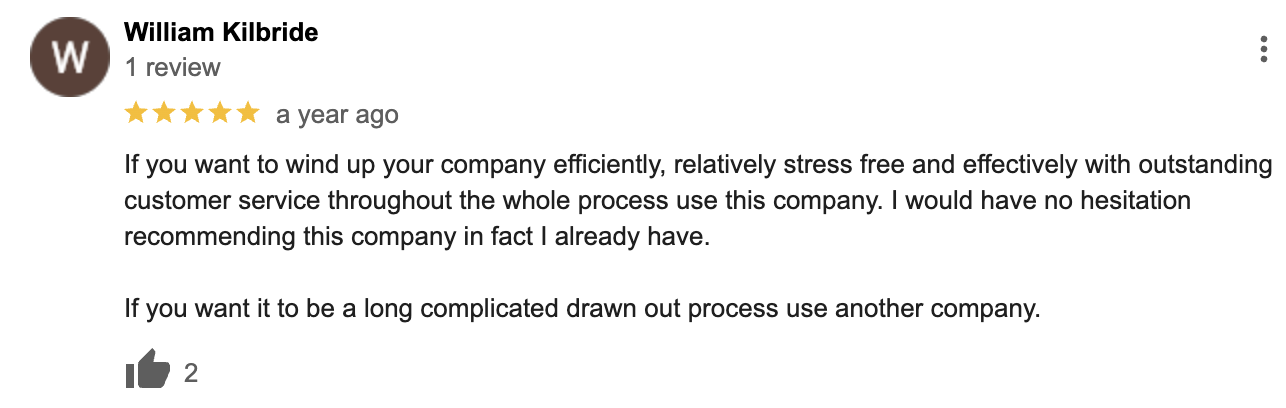

Our Google Reviews

&

Frequently Asked Questions (FAQs)

How long does it take to liquidate a company?

With Anderson Brookes, a business can be placed into liquidation within 8 days, providing rapid protection from creditor action.

Can directors be personally liable for company debts?

Generally, no, but exceptions include personal guarantees, wrongful trading, and fraudulent activity.

What happens to employees during liquidation?

Employees may claim redundancy payments, unpaid wages, and holiday pay from the National Insurance Fund.

Can I start a new business after liquidation?

Yes, but strict rules apply. Directors must ensure they purchase assets at fair market value, inform creditors, and comply with legal guidelines around business continuity.

What protections are available during insolvency?

Insolvency proceedings can pause legal actions, prevent bailiff visits, and protect business assets. The company is placed under the control of a Licensed Insolvency Practitioner, who ensures fair treatment of creditors.

Will ‘closing up shop’ affect my personal credit score?

It depends. A liquidation for example itself does not impact personal credit, but personal guarantees on business loans can result in personal liability, affecting credit ratings. Simply striking off your company without debts shouldn’t at all.

What mistakes should I avoid when striking off a company?

- Leaving funds in the company’s bank account, as they will be transferred to the Crown.

- Attempting to strike off a company with debts, which creditors can challenge.

- Closing a company while still owed money, as debts will be written off and cannot be recovered.

- Failing to consider the impact on trading history, which will be permanently erased.

Key Points…

Understanding the different options available for closing a business is essential in making the right decision. Whether you qualify for voluntary strike-off, MVL, CVL, or administration, taking the right steps ensures compliance and protects you from potential legal and financial risks.

At Anderson Brookes, we specialise in fast, compliant, and cost-effective business closure solutions. Our in-house Licensed Insolvency Practitioner and experienced team ensure that businesses navigate insolvency with minimal disruption. Contact us today for a free consultation and expert advice tailored to your situation.