Step-by-Step Guide to Completing Form DS01: Dissolving Your UK Company

What Is Form DS01?

Form DS01 is the official document used to voluntarily strike off a limited company from the Companies House register. It allows directors to dissolve their company when it’s no longer needed. Quite often businesses owners will do this themselves or with their accountants. An insolvency practitioners we often see when this process is used in error which creates further issues for the Directors and business owners. We are here to discuss your specific case and ensure it is right approach for you – 0800 1804 933.

Quick Summary Table: Step-by-Step Guide to Completing Form DS01

| Step | Description |

| Check eligibility | Confirm the company meets all criteria for dissolution, including no trading or liabilities. |

| Download Form DS01 | Obtain the form from Companies House and review the requirements thoroughly. |

| Complete company details | Fill in the company name and registration number accurately to avoid delays. |

| Provide director signatures | Ensure the majority of directors sign the form; unsigned forms will be rejected. |

| Pay the filing fee | Attach the correct fee payment and verify it aligns with Companies House requirements. |

| Notify stakeholders | Inform creditors, employees, and shareholders of the dissolution process as legally required. |

| Submit the form | Send the completed DS01 form and fee to Companies House for processing. |

| Monitor The Gazette | Watch for the publication of the dissolution notice, giving stakeholders an opportunity to object. |

| Address any objections | Resolve objections raised by creditors or stakeholders promptly to proceed with dissolution. |

| Retain records | Keep copies of the form and proof of filing for at least six years as required by law. |

Risks of Completing Form DS01

| Risk | Description |

| Outstanding debts | Creditors can object to the strike-off, potentially leading to reinstatement of the company. |

| Personal liability | Directors may be held personally liable for unresolved debts or misconduct. |

| Loss of assets | Any undistributed assets become Crown property (bona vacantia) upon dissolution. |

| Legal repercussions | Errors or omissions in the form can result in penalties or rejection of the application. |

| Future reinstatement complications | Stakeholders can seek reinstatement of the company, causing legal and financial complexities. |

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

DS01 – Purpose and Importance

Form DS01 serves as a formal request to remove a company from the register. It’s crucial for businesses that wish to cease operations legally. By filing this form, you inform Companies House of your intent to close the company.

The form requires details about your company and signatures from directors. You must ensure all debts are settled and assets distributed before submission. Companies House will publish a notice of your intention to strike off, allowing creditors or interested parties to object.

Proper completion of Form DS01 is vital to avoid delays or rejection. It helps maintain accurate records at Companies House and prevents potential legal issues for directors.

Risks for Business Owners

Filing Form DS01 carries certain risks for business owners. If you’ve overlooked debts or assets, creditors may object to the strike-off. This can lead to the process being halted or even reversed.

Directors remain liable for company debts after dissolution. If the company is restored to the register later, your responsibilities as a director resume. You might face penalties for failing to file accounts or returns during the strike-off period.

There’s also a risk of losing control over the company name. Once struck off, another business can register using your former company name. Consider these risks carefully before proceeding with Form DS01.

How to Fill Out Form DS01 Correctly

Completing Form DS01 accurately is crucial for successfully dissolving your company. The form requires specific company details and authorised signatures to be valid.

Required Information

On the DS01 form, you’ll need to provide your company’s full registered name and company number. Enter the company’s registered office address as listed with Companies House. Include details of any trading names used in the last 3 years.

List all company directors’ names and addresses. If there are more than 3 directors, use a continuation sheet. Provide the name and address of the company secretary, if applicable.

State the date when your company last traded or the date you intend to cease trading. This helps determine if you meet the eligibility criteria for dissolution.

Obtaining Signatures

At least two company directors must sign the DS01 form for it to be valid. If your company has only one director, their signature alone is sufficient.

Each signing director must print their full name clearly next to their signature. Ensure signatures are original – photocopies or digital signatures are not accepted.

All shareholders must be notified of the application to strike off the company. Keep proof of this notification, as Companies House may request evidence.

If using the online version of DS01, directors can provide electronic signatures. However, they’ll need to authenticate their identity through the Companies House online service.

Submitting Your Application

Properly submitting your DS01 form is crucial for successfully striking off your company. The process involves sending the completed form to the correct address and paying the required fee.

Where to Send the Form

Send your completed DS01 form to the appropriate Companies House office based on your company’s registered location. For companies registered in England and Wales, post the form to Companies House, Crown Way, Cardiff, CF14 3UZ. Scottish companies should send it to Companies House, Fourth Floor, Edinburgh Quayside, 139 Fountainbridge, Edinburgh, EH3 9FF. Northern Irish firms must submit to Companies House, Second Floor, The Linenhall, 32-38 Linenhall Street, Belfast, BT2 8BG.

You can also submit the form online through the Companies House website. This method is often quicker and more convenient.

Filing Fees and Payment Methods

The fee for submitting a DS01 form varies depending on the submission method. Online applications cost £33 (was £8!), while paper submissions are priced at £44 (was £10).

For online submissions, you can pay using a credit or debit card. If sending by post, include a cheque made payable to ‘Companies House’ with your form. Ensure the cheque is signed and dated, with the company number written on the back.

Remember to keep proof of postage or a confirmation email for your records. This evidence may be useful if there are any issues with your application.

Common Mistakes When Filling Form DS01

Completing Form DS01 accurately is crucial for a successful company strike-off. Errors can lead to delays or rejection of your application. Pay close attention to detail and double-check all information before submission.

Incomplete Details

When filling out Form DS01, ensure you provide all required information. Don’t leave any fields blank, as this can result in your application being rejected. Include the full company name, registration number, and registered office address exactly as they appear on Companies House records. List all directors’ names and addresses accurately. If your company has a secretary, include their details as well. Be thorough when describing the company’s trading status and any outstanding debts or liabilities. Incomplete information raises red flags and may prompt further inquiries from Companies House, delaying the strike-off process.

Incorrect Signatures

Proper signatures are vital for Form DS01 to be valid. All company directors must sign the form. If there’s only one director, their signature alone is sufficient. For multiple directors, ensure each one signs in the designated space. Electronic signatures are not accepted on paper forms – use original ink signatures. Don’t forget to print names clearly below each signature. If a director is unable to sign, explain the reason in writing. Incorrect or missing signatures are common reasons for application rejections. Double-check that all required signatures are present and correctly placed before submitting the form.

Need Help Completing Form DS01? We’re Here to Assist

Filling out Form DS01 can seem daunting, but you don’t have to navigate the process alone. Our team can advise and ensure it is a good option for you.

We offer personalised support to ensure your form is filled out accurately and completely. Our services include:

- Reviewing your company’s eligibility for strike-off

- • Explaining each section of the form in plain language

- • Double-checking all entered information for errors

- • Advising on required signatures and deadlines

Don’t risk delays or rejections due to incomplete or incorrect information. Let us help you streamline the process and avoid common pitfalls.

For a smooth and efficient company dissolution, reach out to our dedicated support team. We’re here to answer your questions and provide expert assistance throughout the entire DS01 submission process.

Contact us today to get started. With our help, you can confidently move forward with striking your company off the register.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

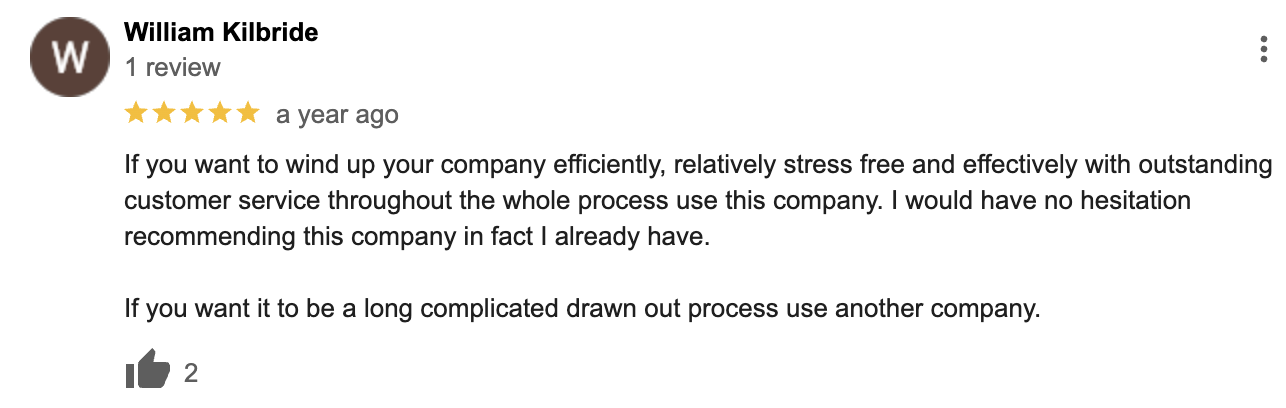

Our Google Reviews

&

Frequently Asked Questions

Completing the DS01 form involves several key steps and considerations. Here are answers to common questions about the process, submission, and requirements.

What are the necessary steps to complete the DS01 form for company dissolution?

To complete the DS01 form, first ensure your company is eligible for dissolution. Then, fill in the company details accurately. List all directors’ names and obtain their signatures. Double-check all information before submission.

Where should the DS01 form be sent after completion?

Send the completed DS01 form to Companies House. You can submit it online through the Companies House website or by post to their Cardiff office.

What is the processing time for a DS01 form submission?

The processing time for a DS01 form is typically around 3 months. Companies House will review your application and publish a notice in the Gazette during this period.

How much is the fee for dissolving a company using form DS01 in the UK?

The fee for dissolving a company using form DS01 in the UK is £33 for online submissions and £44 for paper applications.

Is it mandatory for the DS01 form to be signed by company directors?

Yes, it is mandatory for the DS01 form to be signed by company directors. The majority of directors must sign the form for it to be valid.

Can the DS01 form be submitted electronically, and if so, how?

Yes, you can submit the DS01 form electronically. Visit the Companies House website and use their online service. You’ll need your company authentication code and registered email address to complete the process.

What sectors does Anderson Brookes work in?

We specialise in business debt – company insolvency and liquidations. We also focus on SMEs and work across healthcare, nursing, logistics, pubs and construction insolvency, for example.