Navigating the process of a Creditors’ Voluntary Liquidation (CVL) can feel overwhelming. Having a clear roadmap makes all the difference. In this post, we’ll walk you through a straightforward timeline of what to expect during a CVL: from the swift initial steps that can commence within just days, to the asset realisation, creditor meetings, and final winding-up that typically span several months. Whether you’re a director seeking clarity or facing mounting financial pressure, this guide aims to demystify each stage and help you regain control with confidence.

Table of Contents

Overview of the CVL Timeline

A Creditors’ Voluntary Liquidation (CVL) follows a structured timeline with several key stages. The process typically spans several months, though exact durations can vary based on specific circumstances.

How Long Does the Entire Process Take?

At Anderson Brookes, we can place a business into liquidation within 8 days. The full CVL process usually takes 6 to 12 months from start to finish. However, we have found that getting the start right and in place as soon as possible allows business owners and directors to feel confident and takes the pressure off. This timeframe allows for proper asset realisation and distribution to creditors.

Subsequent stages, including asset sales and creditor claims, may extend over several months. The final winding-up can take additional time, depending on the complexity of the company’s affairs.

Quick CVL Timeline Facts

How long does a CVL take?

Pre-Liquidation Phase:

The initial process to place a company into liquidation can be actioned very swiftly. As we note above, Anderson Brookes can initiate the process in as little as 8 days!

Formal (Post-Liquidation) Phase:

Once the liquidation is underway, the full process typically spans between 12 and 24 months. In many cases, especially when considering the average duration of formal liquidation, you can expect a timeframe of around 9 to 18 months. Notably, director involvement tends to be most significant during the early stages – usually within the first 3 months.

Key Stages in the CVL Process

Director’s Resolution (1–2 weeks):

The directors agree to liquidate the company and appoint an insolvency practitioner.Creditors’ Meeting (2–3 weeks):

Creditors meet to officially approve the CVL.Asset Realisation (3–12 months):

Assets are sold to pay off creditors.Final Reporting (up to 6 months):

The final paperwork is completed, and remaining funds are distributed, marking the closure of the process.

Other considerations…

Potential Delays:

Factors such as incomplete financial records, disputes with creditors, challenges in asset sales, or investigations into director conduct can extend the timeline.Expediting the Process:

To help speed up the process, it is vital to provide accurate and complete financial records, cooperate fully during any director conduct reviews, and work with experienced insolvency practitioners who are well-versed in your sector.

Once all assets have been sold, funds distributed, and legal obligations met, the company is formally struck off the Companies House register, signalling the end of the CVL process.

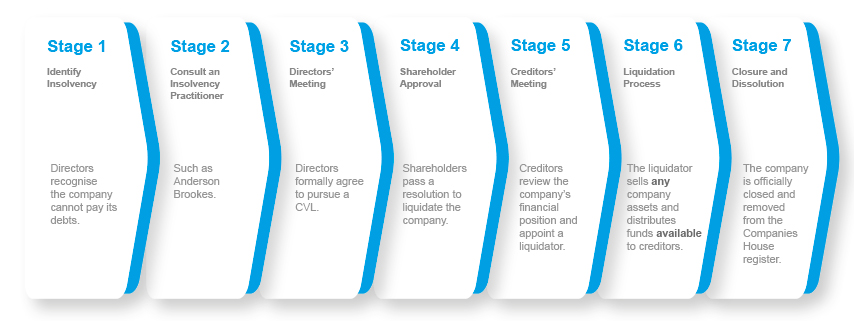

CVL Process: 7 Stages to Ensure an Efficient and Timely Liquidation

Need confidential advice about closing your company? Contact us today.

Key Factors That Can Affect the Timeline

Several elements can impact the duration of a CVL:

- Company size and complexity: Larger businesses with numerous assets and creditors typically require more time.

- Asset types: Easily liquidated assets speed up the process, while unique or specialised assets may take longer to sell.

- Creditor cooperation: Quick responses from creditors can expedite the claims process.

- Legal issues: Any disputes or litigation can significantly extend the timeline.

- Investigative work: If the liquidator needs to conduct in-depth investigations into company affairs, this can add time to the process.

Preparing for a CVL

Proper preparation is crucial when considering a Creditors’ Voluntary Liquidation. You’ll need to carefully assess your company’s financial situation and engage professional help to guide you through the process.

Recognising Insolvency And Making The Decision

Identifying insolvency is the first step in preparing for a CVL. You should review your company’s financial statements, cash flow, and outstanding debts. Key signs of insolvency include:

- Inability to pay bills when due

- Creditors threatening legal action

- Overdue tax payments

- Using credit to pay essential expenses

If you recognise these signs, it’s time to consider your options. A CVL may be appropriate if there’s no realistic chance of recovery. Consult with your fellow directors and shareholders to discuss the situation openly.

Remember, acting promptly can help protect your personal assets and reduce the risk of wrongful trading allegations.

Choosing And Engaging An Insolvency Practitioner

Selecting the right insolvency practitioner (IP) is vital for a smooth CVL process. Look for licensed IPs with experience in your industry. Ask for recommendations from trusted advisors or professional bodies.

When you meet potential IPs, be prepared to:

- Provide detailed financial information

- Explain your company’s situation clearly

- Ask about their fees and processes

Once you’ve chosen an IP, they’ll guide you through the next steps. They’ll prepare necessary documentation and liaise with creditors on your behalf. Your IP will also advise on legal requirements and help you understand your responsibilities throughout the liquidation.

Be open and honest with your chosen IP to ensure the best possible outcome for all parties involved.

Initial Steps in the CVL Process

Directors initiate a Creditors’ Voluntary Liquidation (CVL) when they recognise their company is insolvent. The process involves several key steps to begin winding up the business and informing stakeholders.

Directors’ Meeting and Resolution

The CVL process starts with a directors’ meeting to discuss the company’s financial situation. During this meeting, directors vote on a resolution to wind up the company voluntarily. A majority vote is required to pass the resolution. Once approved, the directors must:

- Appoint a licensed insolvency practitioner as liquidator

- Cease trading immediately to prevent further losses

- Prepare a list of company assets and liabilities

- Notify employees of potential redundancies

It’s crucial to document this meeting thoroughly, as the minutes serve as evidence of the decision to enter liquidation.

Preparation of the Statement of Affairs

After the directors’ meeting, you must prepare a detailed Statement of Affairs. This document provides a snapshot of the company’s financial position, including:

- Assets and their estimated values

- Liabilities, including secured and unsecured creditors

- Details of any floating charges

- Employee claims for unpaid wages and redundancy

The Statement of Affairs must be accurate and comprehensive. It forms the basis for discussions with creditors and helps the liquidator assess the company’s position.

Issuing Notices to Shareholders and Creditors

Once the Statement of Affairs is complete, you must inform shareholders and creditors of the impending liquidation. This involves:

- Sending a notice to shareholders calling for an Extraordinary General Meeting (EGM)

- Issuing a notice to creditors about the company’s intention to enter voluntary liquidation

- Providing creditors with a copy of the Statement of Affairs

The notices must be sent at least 14 days before the EGM. They should include the date, time, and location of the meeting, as well as details on how creditors can participate in the decision-making process. It’s essential to follow proper notification procedures to ensure the liquidation process is legally compliant.

The Creditors' Meeting

The creditors’ meeting is a crucial step in the Creditors’ Voluntary Liquidation (CVL) process. It allows creditors to voice concerns, ask questions, and make important decisions about the company’s future.

Setting The Date And Agenda For The Meeting

Once the decision to liquidate is made, the creditors’ meeting is scheduled within 9 to 21 days. The proposed liquidator notifies creditors of the company’s intention to enter voluntary liquidation. They provide information about the company’s financial position ahead of the meeting.

The agenda typically includes:

- A statement of the company’s affairs

- Nomination of a liquidator

- Appointment of a liquidation committee (if necessary)

Creditors receive notice of the meeting, including the date, time, and location. They may attend in person or appoint a proxy to represent them.

Presentation And Voting Procedures

During the meeting, the company directors present a statement of affairs. This document outlines the company’s assets, liabilities, and financial position. The proposed liquidator explains the liquidation process and answers creditors’ questions.

Voting procedures are as follows:

- Creditors vote on resolutions, such as appointing the liquidator

- Votes are typically based on the value of debt owed to each creditor

- A simple majority (over 50%) is usually required to pass a resolution

Creditors can also form a liquidation committee to represent their interests throughout the process.

Approval Of The Insolvency Practitioner’s Appointment

The appointment of the insolvency practitioner as liquidator is a key decision made at the creditors’ meeting. Creditors have the right to nominate and vote for their preferred liquidator.

If creditors approve the appointment:

- The liquidator takes control of the company’s assets

- They begin the process of realising assets and distributing funds to creditors

If creditors reject the proposed liquidator, they may nominate an alternative. In rare cases where agreement cannot be reached, the court may intervene to appoint a liquidator.

After the appointment, the liquidator must act in the best interests of all creditors. They provide regular updates on the liquidation’s progress and distribute available funds according to the legal order of priority.

Liquidation Activities Post-Creditors' Meeting

After the creditors’ meeting, the liquidator begins the process of winding up the company’s affairs. This involves realising assets, distributing funds, and addressing any claims or disputes.

Realising And Selling Company Assets

The liquidator’s primary task is to convert the company’s assets into cash. This may include:

- Selling physical assets like equipment, inventory, and property

- Collecting outstanding debts owed to the company

- Closing bank accounts and transferring balances

- Terminating ongoing contracts and leases

The liquidator will aim to maximise the value of assets for creditors. They may employ specialist valuers or auctioneers to assist with this process. In some cases, the liquidator might continue trading the business briefly if it will result in a better outcome for creditors.

Distribution Of Funds To Creditors

Once assets are realised, the liquidator distributes funds to creditors according to a strict order of priority:

- Secured creditors

- Preferential creditors (e.g. employees)

- Unsecured creditors

The liquidator will:

- Review and verify all creditor claims

- Calculate the dividend percentage for each class of creditor

- Make interim payments if sufficient funds are available

- Prepare a final report detailing distributions made

It’s important to note that unsecured creditors often receive only a small fraction of their claim, if anything at all.

Addressing Claims And Disputes

During the liquidation process, the liquidator may need to:

- Investigate and pursue any legal claims the company has against third parties

- Defend the company against legal actions brought by creditors or other parties

- Resolve disputes between creditors regarding the validity or priority of claims

The liquidator has the power to compromise on claims and settle disputes if it’s in the best interest of the creditors as a whole. They may seek legal advice or court directions on complex matters.

If any creditor disagrees with the liquidator’s decisions, they can appeal to the court. However, this is relatively rare as it can be costly and time-consuming.

Closure of the CVL Process

The final stages of a Creditors’ Voluntary Liquidation involve important administrative and legal steps. These ensure the proper conclusion of the liquidation process and the official dissolution of the company.

Filing Final Reports With Companies House

Once all company assets have been realised and distributed to creditors, the liquidator prepares final reports. These documents detail the liquidation process, including asset sales, creditor payments, and any remaining funds.

The liquidator submits these reports to Companies House, along with a final account of the winding-up. This account outlines all financial transactions during the liquidation.

You’ll receive copies of these reports as a director. It’s crucial to review them carefully to ensure accuracy and completeness.

Official Dissolution Of The Company

After filing the final reports, the liquidator calls a final meeting of creditors. This meeting allows creditors to review the liquidation process and ask any remaining questions.

Following this meeting, the liquidator files a return with Companies House. This triggers the formal dissolution process.

Companies House will publish a notice in The Gazette, announcing the company’s impending dissolution. After three months, if no objections are raised, your company is officially dissolved and struck off the register.

This marks the end of your company’s legal existence. You’re no longer a director of the dissolved entity.

How Anderson Brookes Helps Expedite The CVL Process

Anderson Brookes streamlines the Creditors’ Voluntary Liquidation process through efficient documentation handling and swift asset realisation. Our expertise helps ensure a smooth and timely liquidation experience for insolvent companies.

Efficient Handling Of Documentation And Communication

We excel in providing time focused solutions to business directors – managing CVL paperwork and correspondence efficiently – while focusing our time on customer service and continued advice and guidance. We promptly prepare all necessary documents, including the Statement of Affairs and Director’s Report. Our team swiftly submits these to relevant authorities, reducing delays.

We maintain clear lines of communication with creditors, keeping them informed throughout the process. We organise and conduct creditors’ meetings efficiently, ensuring all parties are on the same page.

Streamlined Asset Realisation And Fund Distribution

Anderson Brookes employs a systematic approach to asset valuation and sale. Our extensive network of buyers and auctioneers helps achieve fair market prices swiftly.

Our experts quickly identify and secure company assets, preventing any unauthorised disposal.

We also negotiate with secured creditors to release assets when appropriate, further expediting the process.

Frequently Asked Questions

Creditors’ Voluntary Liquidation involves several key aspects that companies and directors often have questions about. Understanding the process, timeline, and implications is crucial for those considering this option.

How long does the process of a Creditors’ Voluntary Liquidation typically last?

The duration of a Creditors’ Voluntary Liquidation (CVL) can vary depending on the complexity of the company’s affairs. Generally, a CVL takes between 6 to 18 months to complete.

Factors influencing the timeline include the size of the company, the number of creditors, and the complexity of asset sales. Simple cases may resolve more quickly, while complex situations could extend the process.

What are the stages involved in the Creditors’ Voluntary Liquidation process?

The CVL process typically involves several key stages. Initially, directors decide to liquidate the company and appoint a licensed insolvency practitioner.

Next, shareholders and creditors meetings are held, usually within 9-18 days. The liquidator is officially appointed at the creditors’ meeting.

The liquidator then proceeds to realise the company’s assets, investigate its affairs, and distribute funds to creditors. Finally, the company is dissolved.

What are the consequences for directors during a company’s Creditors’ Voluntary Liquidation?

During a CVL, directors’ powers cease once the liquidator is appointed. You are required to cooperate fully with the liquidator and provide all necessary information about the company.

Directors may face personal liability if found guilty of wrongful trading or other misconduct. However, if you’ve acted responsibly and ethically, a CVL shouldn’t negatively impact your future business endeavours.

What distinguishes a Creditors’ Voluntary Liquidation from a Members’ Voluntary Liquidation?

The key difference lies in the company’s solvency. A Creditors’ Voluntary Liquidation is for insolvent companies unable to pay their debts.

A Members’ Voluntary Liquidation, on the other hand, is for solvent companies that can pay all creditors in full. It’s typically used when shareholders wish to close a viable business and extract value.

Can you explain the advantages and disadvantages of Creditors’ Voluntary Liquidation for a company?

Advantages of CVL include stopping creditor pressure and preventing compulsory liquidation. It allows for an orderly winding up of the company’s affairs.

Disadvantages include the loss of the business and potential job losses. Directors’ conduct will be investigated, which could lead to disqualification if misconduct is found.

What occurs at a creditors’ meeting during the liquidation process?

The creditors’ meeting is a crucial part of the CVL process. It’s held remotely and follows the shareholders’ meeting.

During this meeting, creditors are informed about the company’s financial situation. They can ask questions about the company’s affairs and vote on the appointment of the liquidator.

The meeting also provides an opportunity for creditors to form a liquidation committee to represent their interests throughout the process.