Trading While Insolvent: Risks and Responsibilities for UK Directors – Legal Consequences and Best Practices

What Is Trading While Insolvent?

Trading while insolvent occurs when a company continues to operate despite being unable to meet its financial obligations. This practice carries significant legal and financial risks for directors.

Definition of Insolvency

Insolvency refers to a company’s inability to pay its debts as they fall due or when its liabilities exceed its assets. In the UK, two main tests determine insolvency:

- Cash flow test: Can the company pay its debts when they become due?

- Balance sheet test: Do the company’s liabilities outweigh its assets?

If a company fails either test, it is considered insolvent. Directors must be vigilant in monitoring their company’s financial health to avoid inadvertently trading whilst insolvent.

Indicators of Insolvent Trading

Several signs may indicate that your company is trading while insolvent:

- Persistent cash flow problems

- Mounting unpaid debts to suppliers or HMRC

- Bounced cheques or rejected direct debits

- Difficulty obtaining credit from suppliers

- Reliance on high-interest loans or overdrafts

- Failing to file annual accounts or tax returns

If you notice these warning signs, it’s crucial to take immediate action. Seek professional advice to assess your company’s financial position and explore options for restructuring or entering formal insolvency proceedings if necessary.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Legal Implications of Trading While Insolvent

Directors face serious legal and financial consequences for continuing to trade when their company is insolvent. The law imposes strict duties on directors to protect creditors’ interests once insolvency becomes apparent.

Wrongful Trading Under the Insolvency Act 1986

The Insolvency Act 1986 establishes the offence of wrongful trading. You commit wrongful trading if you knew or ought to have concluded that there was no reasonable prospect of avoiding insolvent liquidation, yet continued trading anyway. The court looks at your knowledge, skill and experience to determine if you should have known.

To avoid liability, you must take every step to minimise potential losses to creditors. This may include:

- Seeking professional advice

- Informing all directors/shareholders

- Closely monitoring the financial position

- Considering formal insolvency procedures

If found liable, you may have to make a personal contribution to the company’s assets.

Consequences for Directors

The repercussions of trading whilst insolvent can be severe. You may face:

- Personal liability for company debts

- Disqualification as a director for 2-15 years

- Fines or imprisonment in extreme cases

- Damage to your professional reputation

Disqualification prevents you from acting as a director or being involved in forming, marketing or running a company. It can also impact other areas of your life, potentially barring you from certain professions like accountancy or law.

To protect yourself, always act in creditors’ best interests once insolvency is on the horizon. Seek expert advice early and document all decisions carefully.

Risks Associated with Insolvent Trading

Directors who continue trading whilst their company is insolvent face significant legal and financial dangers. These risks can have severe personal consequences and impact future business prospects.

Personal Liability for Company Debts

If you trade whilst insolvent, you may become personally responsible for the company’s debts. This means creditors could pursue your personal assets to recover money owed.

Courts can order you to contribute to the company’s assets if wrongful trading is proven. The amount could be substantial, potentially covering all debts incurred after the point of insolvency.

Your personal finances and property, including your home, may be at risk. This liability extends beyond the protection of limited company status.

Potential Disqualification from Directorship

Trading whilst insolvent can lead to disqualification from acting as a company director. The Insolvency Service may investigate your conduct and bring disqualification proceedings.

If found guilty of wrongful trading, you could face a disqualification order lasting 2 to 15 years. During this period, you cannot:

- Be a director of any UK company

- Be involved in forming, promoting, or managing a company

- Act as an insolvency practitioner

This ban can severely limit your future business opportunities and damage your professional reputation. It may also affect your ability to secure employment in senior management roles.

Identifying Signs of Insolvency

Recognising the early warning signs of insolvency is crucial for UK company directors. Being aware of these indicators can help you take timely action to address financial difficulties and meet your legal obligations.

Cash Flow Difficulties

Cash flow problems often signal potential insolvency. Watch for:

- Inability to pay bills on time

- Struggling to meet payroll obligations

- Repeatedly maxing out credit lines

- Declining sales or profit margins

If you’re regularly juggling payments or using one credit line to pay off another, it’s time to reassess your financial situation. Consistent late payments to suppliers or HMRC can quickly escalate into more serious issues.

Balance Sheet Insolvency

Balance sheet insolvency occurs when a company’s liabilities exceed its assets. Key indicators include:

- Negative net asset value

- Accumulating losses over multiple accounting periods

- Declining inventory levels without corresponding sales increases

- Difficulty securing new financing or credit

Review your balance sheet regularly. If you notice a trend of decreasing assets or increasing liabilities, take immediate action to address the imbalance.

Creditor Pressure and Legal Actions

Mounting pressure from creditors often indicates financial distress. Be alert to:

- Increasing number of creditor demands or threats

- Receipt of statutory demands or court summons

- Visits from bailiffs or debt collectors

- Suppliers insisting on cash-on-delivery terms

If you’re facing legal actions or receiving final notices from multiple creditors, it’s crucial to seek professional advice promptly. Ignoring these signs can lead to personal liability and potential disqualification as a director.

Steps Directors Should Take When Facing Insolvency

Directors facing insolvency must act quickly and responsibly to protect creditors’ interests and fulfil their legal obligations. Taking prompt action can help minimise losses and potentially save the company.

Seek Professional Insolvency Advice

Engaging a licensed insolvency practitioner is crucial when your company faces financial distress. These experts can assess your situation objectively and provide tailored guidance.

They’ll help you understand your options, which may include:

- Company Voluntary Arrangement (CVA)

- Administration

- Liquidation

Professional advice ensures you make informed decisions and comply with legal requirements. It also demonstrates your commitment to acting in creditors’ best interests, which can protect you from personal liability.

Remember, seeking help early often leads to better outcomes for all parties involved.

Maintain Accurate Financial Records

Keeping detailed and up-to-date financial records is essential when facing insolvency. This practice helps you:

- Monitor cash flow closely

- Identify potential areas for cost-cutting

- Provide accurate information to creditors and insolvency practitioners

Ensure you have:

- Recent balance sheets

- Profit and loss statements

- Cash flow forecasts

- Detailed lists of assets and liabilities

Accurate records also protect you from allegations of wrongful trading or misconduct. They demonstrate your efforts to manage the company responsibly during financial difficulties.

Communicate with Creditors

Open and honest communication with creditors is vital when your company is insolvent. It can help maintain relationships and potentially secure their support for rescue plans.

Key steps include:

- Inform creditors promptly about your financial situation

- Explain any proposed restructuring or turnaround plans

- Provide regular updates on progress or changes in circumstances

Be transparent about payment timelines and any difficulties meeting obligations. Consider negotiating payment terms or temporary arrangements to ease cash flow pressures.

Remember, creditors often prefer to work with cooperative directors who show a genuine commitment to resolving the situation.

Legal Protections and Defences for Directors

Directors facing potential liability for trading whilst insolvent have certain legal protections and defences available to them. These safeguards aim to protect directors who have acted responsibly and in good faith during challenging financial circumstances.

Demonstrating Reasonable Steps Taken

To defend against claims of wrongful trading, directors must show they took reasonable steps to minimise potential losses to creditors. This involves actively monitoring the company’s financial position and seeking professional advice when necessary.

Key actions that may help demonstrate reasonable steps include:

- Regularly reviewing management accounts

- Holding frequent board meetings to discuss the company’s financial situation

- Seeking advice from insolvency practitioners or solicitors

- Considering alternative financing options or restructuring plans

- Reducing company expenses and halting non-essential spending

Directors should also be prepared to explain their rationale for continuing to trade, such as believing there was a realistic prospect of avoiding insolvency or securing additional funding.

Importance of Documenting Decisions

Thorough documentation of all decisions and actions taken during periods of financial distress is crucial for directors’ protection. This creates a clear audit trail that can be used to demonstrate responsible behaviour if challenged later.

Essential documentation includes:

- Minutes of board meetings

- Financial reports and forecasts

- Correspondence with creditors and stakeholders

- Records of professional advice received

- Details of cost-cutting measures implemented

By maintaining comprehensive records, you can provide evidence of your decision-making process and show that you acted in the best interests of creditors. This documentation may prove invaluable in defending against potential claims of wrongful trading or breach of director duties.

Alternatives to Continuing to Trade While Insolvent

Directors facing insolvency have several options to address the situation responsibly. These alternatives can help protect creditors’ interests and potentially save the business from complete closure.

Company Voluntary Arrangement (CVA)

A CVA offers a structured way to repay creditors over time. You’ll work with an insolvency practitioner to propose a payment plan to your creditors. This arrangement allows your company to continue trading while repaying debts.

Key benefits of a CVA:

- Retain control of your business

- Freeze interest and charges on debts

- Consolidate payments into a single monthly sum

To initiate a CVA, you’ll need approval from 75% of your creditors by value. Once approved, it becomes legally binding for all unsecured creditors.

CVAs typically last 3-5 years. During this time, you must stick to the agreed payment schedule. If successful, your company can emerge debt-free and continue trading.

Administration

Administration provides breathing space to restructure your business. An administrator takes control to protect the company from creditor actions. Their goal is to rescue the business as a going concern.

The administration process:

- Appoint an administrator

- Develop a rescue plan

- Implement changes to improve viability

Administration can last up to a year, with possible extensions. During this time, you’re protected from legal action by creditors. The administrator may continue trading, sell assets, or restructure operations.

If rescue isn’t possible, the administrator may recommend liquidation. However, administration often results in better outcomes for creditors than immediate liquidation.

Voluntary Liquidation

Creditors’ Voluntary Liquidation (CVL) is an orderly way to close an insolvent company. You’ll appoint a liquidator to wind up the business and distribute assets to creditors.

Steps in a CVL:

- Directors meet to propose liquidation

- Shareholders vote on the resolution

- Creditors’ meeting to appoint a liquidator

- Liquidator realises assets and distributes funds

While liquidation means the end of your company, it can protect you from wrongful trading accusations. It’s often the best option when rescue attempts have failed or are unlikely to succeed.

By choosing voluntary liquidation, you demonstrate responsibility towards creditors. This can help preserve your reputation and avoid potential disqualification as a director.

How Anderson Brookes Can Assist

Anderson Brookes offers crucial support to directors facing insolvency concerns. Our team provides expert guidance, helps navigate legal obligations, and offers a free initial consultation to assess your situation. If a liquidation is the right option – we can place a company into liquidation within 8 days!

Expert Guidance on Insolvency Matters

Anderson Brookes boasts a team of experienced insolvency practitioners who understand the complexities of financial distress. We can help you:

- Assess your company’s financial position

- Explore restructuring options

- Develop strategies to improve cash flow

- Negotiate with creditors on your behalf

Our experts stay up-to-date with the latest insolvency laws and regulations, ensuring you receive accurate and timely advice.

Support in Navigating Legal Obligations

As a director, you have specific legal duties when your company is insolvent. Anderson Brookes can:

- Explain your responsibilities under the Insolvency Act 1986

- Help you avoid wrongful or fraudulent trading accusations

- Guide you through the process of placing your company into administration or liquidation, if necessary

- Assist with preparing required documentation for insolvency proceedings

We aim to protect your interests whilst ensuring compliance with all relevant laws.

Free Initial Consultation

Anderson Brookes offers a no-obligation initial consultation to discuss your company’s situation. During this meeting, we will:

- Review your financial documents

- Assess the severity of your insolvency concerns

- Outline potential courses of action

- Answer any questions you may have about the insolvency process

This consultation allows us to understand your unique circumstances and provide tailored advice. You’ll gain valuable insights into your options without any upfront cost or commitment.

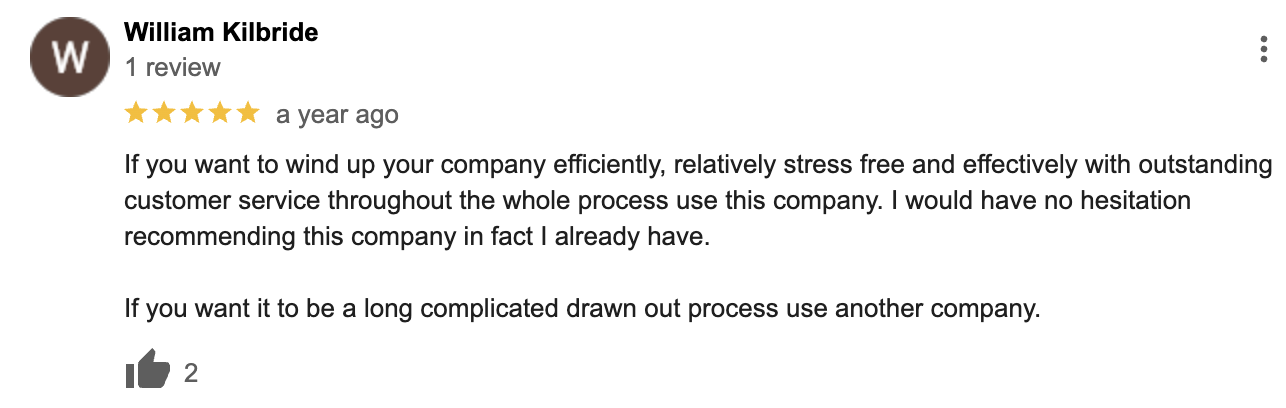

Google Reviews

&

Trading While Insolvent – Frequently Asked Questions

Directors facing potential insolvency need to understand the risks to ensure they can manage them properly – ensuring compliance with UK law.

What are the consequences of engaging in wrongful trading under the Insolvency Act?

Wrongful trading can result in personal liability for company debts. Directors may be required to contribute to the company’s assets.

Disqualification from acting as a director for up to 15 years is another potential consequence. Criminal charges are possible in severe cases of misconduct.

How can directors fulfill their duties when facing potential insolvency?

Directors must prioritise creditors’ interests over shareholders’. Seeking professional advice from insolvency practitioners or solicitors is crucial.

Maintaining accurate financial records and documenting decision-making processes is essential. Regular board meetings should be held to assess the company’s financial position.

What steps should directors take to mitigate risks when suspecting their company might be insolvent?

Conduct a thorough review of the company’s financial position. Consider all available options, including restructuring or entering into a formal insolvency procedure.

Cease incurring new credit if there’s no reasonable prospect of repayment. Communicate transparently with creditors and stakeholders about the company’s situation.

What liabilities do directors face if they continue to trade while insolvent?

Directors may be held personally liable for company debts incurred after insolvency. This can include repaying creditors from personal assets.

Disqualification from acting as a director and reputational damage are additional risks. In extreme cases, criminal charges for fraudulent trading may apply.

Are there any defences available for directors accused of insolvent trading?

Directors can defend themselves if they took every step to minimise potential losses to creditors. This is known as the ‘reasonable steps’ defence.

Proving that continuing to trade was in the best interests of creditors can also be a valid defence. Detailed records of actions taken and professional advice sought are crucial.

How does administration affect the ability of a company to continue trading?

Administration provides a company with protection from creditor actions. This can allow for continued trading under the administrator’s supervision.

The administrator may choose to continue trading if it benefits creditors. They might also wind down operations gradually or sell the business as a going concern.