CVL Costs

Facing the prospect of liquidation can feel like the end of the road for your business, but it doesn’t have to be the end of your career or financial future. A Creditors’ Voluntary Liquidation (CVL) offers a structured way out while also helping you manage personal liability. If you’re struggling with mounting debt, unpaid invoices, or a sharp decline in sales, you’re not alone. Many directors have faced similar challenges and have turned to CVL for closure.

In this article, we’ll provide a comprehensive overview of the costs associated with a CVL, factors that influence these costs, and strategies to minimise expenses. If you’re unsure whether CVL is the right option for your business, don’t worry. We’re here to walk you through the process and help you understand your options in detail.

The Two Sets of Fees in a CVL

When considering the costs of a CVL, it’s important to understand that there are two separate sets of fees involved:

-

Statement of Affairs (SOA) Fee

The SOA fee is charged by the insolvency practitioner (us) for assisting the director in placing the company into liquidation. This fee covers the preparation of all paperwork, sending notices to creditors, and holding the meetings to place the company into liquidation. The SOA fee typically ranges from £3,000 to £8,000 and must be paid before the company goes into CVL. It is payable from the company’s assets or by the director personally if there are no assets.

-

Liquidator’s Fee

The Liquidator’s fee is charged for the work carried out by the liquidator during the CVL process, from immediately after the creditors’ meeting (when the company goes into CVL) to the closure of the case. This fee is only payable from asset realisations, and if there are no assets, it is common for no Liquidator’s fee to be drawn. However, the liquidator is still required to carry out their duties regardless of whether a fee is drawn.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

CVL Costs – Google Review

Factors Affecting the Cost of a CVL

Several factors can influence the overall cost of a CVL, including:

- Company Size and Complexity: Larger companies with more complex financial arrangements may require more work from the insolvency practitioner, resulting in higher fees.

- Asset Realisation: The costs associated with realising assets, such as valuation fees and legal costs, can impact the overall cost of the CVL.

- Creditor Engagement: The number of creditors and the complexity of their claims can affect the time and resources required by the liquidator, influencing the overall cost.

- Debt Levels and Financial Complexity: If your business has complex debts, there may be additional costs related to negotiating settlements or working out a creditor agreement.

- Timeframe for Liquidation: Delaying the decision to liquidate can increase costs. Businesses that wait too long may accrue more debts, making the liquidation process more complex and expensive.

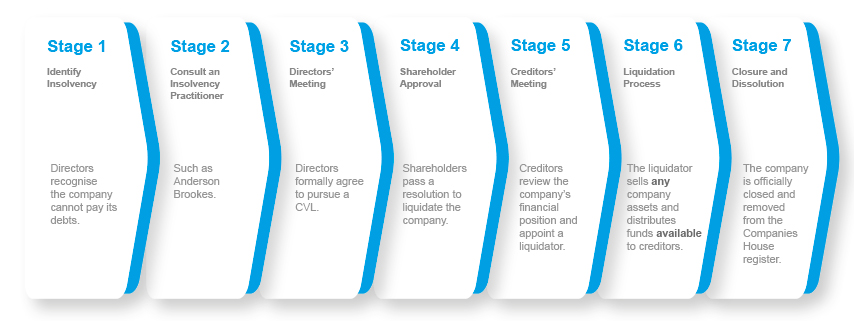

The CVL Process

Time Required: We can place a company company into liquidation within 8 days of instruction.

Is the Cost of a CVL Worth It?

While the costs of a CVL can be significant, it’s important to weigh them against the potential benefits:

- A CVL allows you to close your insolvent business and write off qualifying debts, providing a fresh start.

- Once the CVL process begins, creditors are prevented from taking legal action against your company, offering protection and relief from the stress of dealing with aggressive creditors.

- A CVL can protect a director’s personal assets, which is especially important when personal guarantees are at risk. If you have personal guarantees on loans or debts, a CVL can limit your personal exposure, as the liquidation process is handled by professionals who work to address these issues.

- Trying to keep a struggling business afloat can be incredibly time-consuming and stressful. While continuing to struggle may seem like the right choice, the financial strain and stress on your personal life can be significant. A CVL allows you to take back control by giving you a clear exit strategy.

See advantages of a CVL.

How to Minimise the Costs of a CVL

There are several ways to minimise the costs of a CVL:

- Acting quickly when you first suspect your company is insolvent can help reduce costs. If you wait too long, the situation may worsen, and business debts can compound, making the liquidation process more complicated and expensive.

- Maintaining accurate and up-to-date financial records can help the liquidator quickly assess your company’s financial situation, reducing the time and costs involved in the CVL process.

- Cooperating fully with the liquidator and promptly providing any requested information can help streamline the process and reduce costs.

- Working with the liquidator to identify and realise assets in a timely and efficient manner can help cover the costs of the CVL and maximise returns to creditors.

CVL Example Case Studies

Anderson Brookes has worked with thousands of business owners and directors! We work with businesses large and small.

Small Company CVL Case Study:

John, the owner of a struggling pub in the North West, sought guidance from Anderson Brookes. The pub had built up debts of around £70,000, mainly to HMRC, due to declining sales and poor financial advice.

After reviewing the pub’s financial situation and failed attempts at a ‘time to pay’ arrangement with HMRC, it was apparent that the business was no longer sustainable. John had provided personal guarantees to the bank and was worried about the consequences of the pub’s insolvency.

Anderson Brookes advised John that a CVL would be the best course of action to minimise his personal exposure and deal with the pub’s debts in an orderly way. We assisted John throughout the process, handling creditor claims, employee redundancies, and asset realisation. This allowed John to close the pub, address the outstanding debts, and move forward with a fresh start.

Large Company CVL Case Study:

The directors of a facilities management company in the Midlands with a £22 million turnover approached Anderson Brookes for advice due to mounting financial pressures. The company had accumulated substantial HMRC liabilities and was unable to agree on a payment plan.

After carefully analysing the company’s financial situation, it became clear that the business was no longer viable in its current form. Restructuring options were limited due to ongoing losses and unsustainable outgoings.

Anderson Brookes advised the directors to pursue a Creditors’ Voluntary Liquidation (CVL) to avoid further losses and potential personal liability. We assisted in preparing the necessary documents, dealing with creditor claims, and maximising returns from company assets. This allowed the directors to close the company in an orderly manner and move on.

CVL Preparation Checklist

Before proceeding with a Creditors’ Voluntary Liquidation, ensure your documentation is complete:

- Financial Records: Gather up-to-date accounts, bank statements, tax returns, and all other relevant financial documents. ✅

- Creditor Information: Compile a comprehensive list of all creditors, detailing amounts owed and payment histories. ✅

- Statement of Affairs (SOA): Prepare the SOA with the assistance of a licensed insolvency practitioner, ensuring that all assets and liabilities are accurately recorded. ✅

- Contracts & Agreements: Secure copies of contracts, leases, and any other agreements that could affect the liquidation process. ✅

- Personal Guarantees: Document all personal guarantees or loans, as these may influence your personal liability. ✅

How Can Directors Protect Themselves from Personal Liability in a CVL?

As a director, you have a duty to act in the best interests of your company and its creditors. To protect yourself:

- Act Promptly: If you believe your company is insolvent, seek professional advice immediately. Continuing to trade when you know the company is insolvent could lead to accusations of wrongful trading.

- Seek Professional Advice: Engage with a licensed insolvency practitioner as soon as possible. They can assess your situation and advise on the best course of action to minimise the risk of personal liability. Seeking professional help early on can help you assess whether wrongful trading applies to your situation and what steps you can take to limit your personal exposure.

- Keep Accurate Records: Maintain detailed financial records and minutes of board meetings to demonstrate that you have acted in the best interests of the company and its creditors.

- Understand Your Duties: Familiarise yourself with your duties as a director, particularly in relation to insolvency, to ensure you are acting in compliance with the law.

Alternative Options to a CVL

While a CVL can be an effective way to close an insolvent business, it’s not the only option. Other alternatives include:

- A Company Voluntary Arrangement (CVA) is a formal agreement between a company and its creditors to repay debts over a fixed period. This can be a good option if your business is viable but needs time to restructure and repay debts. A CVA may be better suited for businesses with a viable future but temporary cash flow problems.

- Administration is a formal insolvency process where a licensed insolvency practitioner takes control of the company with the aim of rescuing the business, if possible, or achieving a better outcome for creditors than a liquidation.

- Compulsory Liquidation, which is creditor initiated. We compare a CVL and Compulsory Liquidation in detail.

- A Company Dissolution for solvent businesses.

- Informal Arrangements – in some cases, it may be possible to negotiate informal arrangements with creditors, such as debt repayment plans or debt write-offs, without entering a formal insolvency process.

Here’s a side-by-side comparison of CVL with other options:

Option |

Cost | Pros | Cons |

| CVL | SOA Fee: £3,000 – £8,000, Liquidator’s Fee: Varies | Closes insolvent business, writes off qualifying debts, protects from legal action | Ends the business, director investigation |

| CVA | £1,000 – £5,000 | Allows business to continue trading, repays debts over time | Requires creditor approval, does not write off debts |

| Administration | £5,000 – £15,000 | Protects from legal action, aims to rescue the business | Higher costs, loss of director control |

| Informal Arrangements | Variable | Flexible, lower costs | No legal protection, requires creditor agreement |

The most suitable option will depend on your company’s specific circumstances, so it’s important to seek professional advice to determine the best course of action.

Contact us today to discuss your options.

Key Stakeholders in a CVL and Their Impact on Costs

When considering the costs associated with a Creditors’ Voluntary Liquidation (CVL), it’s essential to understand the roles and responsibilities of the key stakeholders involved. Each participant plays a critical part in the process, and their actions can influence the overall costs and outcomes of the CVL.

-

Directors

- Initiate the CVL process by seeking professional advice

- Provide accurate and timely information to the insolvency practitioner

- Prepare the Statement of Affairs (SOA) with the help of the insolvency practitioner

- Directors’ cooperation and transparency can help streamline the process and reduce costs

-

Shareholders

- Pass a resolution for voluntary winding up at a shareholders’ meeting

- Their approval is necessary to proceed with the CVL

- Shareholders’ understanding and support of the process can help minimise delays and additional costs

-

Insolvency Practitioner (IP)

- Advises directors on the CVL process and their duties

- Acts as the liquidator once appointed by creditors

- Manages the CVL process, including asset realisation and distribution to creditors

- The IP’s expertise and efficiency in handling the CVL can significantly impact the overall costs

- Choosing an experienced and reputable IP, such as Anderson Brookes, can help ensure a cost-effective and smooth CVL process

-

Creditors

- Attend the creditors’ meeting to vote on the appointment of the liquidator

- Submit their claims for the money owed to them

- Receive proceeds from asset realisations based on their priority

- Creditors’ cooperation and understanding of the CVL process can help reduce costs

- Disputes or legal actions taken by creditors can increase the costs and duration of the CVL

When considering the costs of a CVL, it’s important to factor in the roles and actions of these key participants. By working with experienced professionals, such as Anderson Brookes, directors can ensure that all stakeholders are well-informed and engaged throughout the process. This collaboration and transparency can help minimise delays, disputes, and ultimately, the overall costs of the CVL.

How Anderson Brookes Can Help with Creditors’ Voluntary Liquidation (CVL)

At Anderson Brookes, we understand that considering a CVL for your business can be a daunting and stressful experience. Our licensed insolvency practitioner and experienced advisors are here to provide impartial advice and support throughout the process, ensuring that you understand your duties and obligations as a director.

With years of experience in helping thousands of companies navigate the complexities of insolvency, we have the knowledge and expertise to assist you in making informed decisions about your company’s future.

Our goal is to provide you with clear, practical advice and to help you understand your options, so you can proceed with the most appropriate course of action.

Comprehensive CVL Services

When you choose Anderson Brookes for your company’s CVL, you can expect:

- A free, confidential consultation to assess your company’s financial situation and discuss the CVL process. During this consultation, we’ll gather information about your business, its assets, liabilities, and creditors to determine whether a CVL is the most appropriate course of action.

- Our team will assist you in preparing the Statement of Affairs (SOA), a comprehensive document detailing your company’s assets, liabilities, and creditors. We’ll work with you to ensure that all relevant information is accurately captured and presented.

- Once you’ve decided to proceed with a CVL, we’ll appoint a licensed insolvency practitioner from our team to act as the liquidator. The liquidator will be responsible for managing the CVL process, realising assets, and distributing proceeds to creditors in accordance with the Insolvency Act 1986 and other relevant legislation.

- We’ll handle all communication with your company’s creditors, including sending notices of the CVL and providing regular updates on the progress of the liquidation. This ensures that creditors are kept informed and that the process is transparent.

- Our team will work diligently to identify and realise your company’s assets, ensuring that the proceeds are maximised for the benefit of creditors. We have extensive experience in valuing and selling a wide range of business assets, from inventory and equipment to property and intellectual property.

- As part of the CVL process, the liquidator will conduct a thorough investigation into your company’s affairs, including its financial transactions and the conduct of its directors. We’ll prepare detailed reports for submission to the relevant authorities, as required by law.

- Once all assets have been realised and proceeds distributed to creditors, we’ll handle the final closure and dissolution of your company. Our team will ensure that all necessary paperwork is filed, and your company is officially removed from the register at Companies House.

CVL Google Reviews

&

Transparent Fees and Process

We believe in transparency when it comes to our fees and the CVL process. We’ll provide you with a clear breakdown of our charges upfront, so you know exactly what to expect. Our fees are highly competitive and based on the complexity of your case and the work required to achieve the best possible outcome for creditors.

Throughout the CVL process, we’ll keep you informed of any developments and provide regular updates on the progress of the liquidation. Our team is committed to ensuring that the process is carried out in accordance with all relevant laws and regulations.

Get in Touch

If your company is facing financial difficulties and you’re considering a Creditors’ Voluntary Liquidation, we encourage you to get in touch with our team at Anderson Brookes. We offer a free, confidential consultation to discuss your situation and explore your options.

You can reach us by phone, email, or by completing our online contact form.

Questions? Speak to an expert today! 0800 1804 933

We understand that taking the first step can be difficult, but we’re here to provide impartial advice and support throughout the process. x

Key Takeaways

- A CVL involves two sets of fees: the Statement of Affairs fee and the Liquidator’s fee.

- The Statement of Affairs fee is paid by the company or the director before the CVL, while the Liquidator’s fee is only payable from asset realisations.

- Early intervention, accurate records, and cooperation with the liquidator can help minimise the costs of a CVL.

- Directors can protect themselves from personal liability by acting promptly, seeking professional advice, and keeping accurate records.

- Alternative options to a CVL include CVAs, administration, dissolution and informal arrangements.

If you’re considering a CVL, the first step is to reach out to an experienced insolvency practitioner to discuss your situation. They can provide you with a clear understanding of the costs involved and guide you through the process.

You may also be interested in:

FAQs on the Costs of a CVL

- What happens to my personal guarantees during a CVL? Personal guarantees are not automatically written off in a CVL. However, the liquidator will work to realise assets and distribute funds to creditors, which can help reduce the amount you may be personally liable for.

- Will I still be able to run a business after a CVL? Yes, a CVL does not prevent you from running a business in the future, unless you are subject to director disqualification proceedings.

- Can I avoid personal bankruptcy through a CVL? A CVL can help you avoid personal bankruptcy by closing your insolvent company and writing off qualifying debts. However, if you have significant personal guarantees or other personal debts, you may still be at risk of personal bankruptcy.

- How long does a CVL take? A company working with an IP, such as Anderson Brookes, can be placed into liquidation within 8 days of instruction. The length of a CVL can vary, but it typically takes between 6 to 12 months from the date of appointment of the liquidator to the final closure of the company.

- Can I set up a new company with the same name after a CVL? No, it is an offence for a director of a liquidated company to use a name that is the same or similar to the name of the old company for a period of 5 years, unless specific criteria are met.

Click here to see further CVL FAQs. You may also find our CVL Glossary of Terms useful below:

Useful Glossary of Key Terms

- Administration: A formal insolvency procedure where a licensed insolvency practitioner is appointed to manage the company with the aim of rescuing the business or achieving a better outcome for creditors.

- Assets: Anything of value owned by the company, such as property, equipment, or inventory.

- Company Voluntary Arrangement (CVA): A formal agreement between a company and its creditors to repay debts over a fixed period.

- Creditors: Individuals or organisations to whom the company owes money.

- Creditors’ Voluntary Liquidation (CVL): A formal insolvency procedure initiated by the directors of an insolvent company to wind up the business and distribute its assets to creditors.

- Director: A person appointed to manage and make decisions on behalf of a company.

- Director Disqualification: A legal process that bans an individual from acting as a director for a specified period, usually due to misconduct or breaches of duty.

- Insolvency: A company is insolvent when it can’t pay its debts when they fall due or when its liabilities exceed its assets.

- Insolvency Practitioner: A licensed professional who specialises in helping companies navigate insolvency procedures, such as CVLs.

- Liquidation: The process of closing a company, realising its assets, and distributing the proceeds to creditors.

- Liquidator: A licensed insolvency practitioner appointed to manage the liquidation process.

- Personal Guarantee: A legal promise made by an individual, often a director, to repay a company’s debts if the company is unable to do so.

- Realisations: The proceeds generated from selling a company’s assets during the liquidation process.

- Statement of Affairs (SOA): A comprehensive document detailing a company’s assets, liabilities, and creditors, prepared by the directors with the assistance of an insolvency practitioner.

- Wrongful Trading: Continuing to trade when a director knows, or ought to know, that there is no reasonable prospect of the company avoiding insolvent liquidation.

Still have questions? Contact us why not look at our full Insolvency Glossary for more answers.

advice@andersonbrookes.co.uk or call on 0800 1804 933