What Happens to Company Assets After a Strike Off? Exploring the Aftermath for Business Property

When a company is struck off the register, it ceases to exist as a legal entity, leaving many business owners wondering about the fate of their company’s assets. In this article, we at Anderson Brookes, a firm of licensed insolvency practitioners, aim to shed light on what happens to company assets after a strike-off and the implications for business property.

With years of experience in helping businesses with financial challenges, we understand the complexities and concerns that arise when a company faces the possibility of being struck off. Our team is dedicated to providing clear, concise advice to business owners, ensuring they are well-informed and equipped to make the best decisions for their unique situations.

Throughout this article, we will explore the various scenarios that may unfold when a company is struck off, focusing specifically on the distribution of assets and the potential impact on business property. We will provide practical guidance for business owners who may be facing this challenging situation.

Let’s start with a quick summary of the key points you may be considering.

Summary Table – Quick Answers: Asset Implications of Striking Off a Company

| Scenario | What Happens to Assets |

| Company owns physical assets | Assets such as equipment, stock, or property become the property of the Crown (bona vacantia) unless claimed by shareholders. |

| Company bank accounts | Funds in the account are frozen and may be passed to the Crown. Shareholders must apply to recover them. |

| Outstanding debts | Creditors can no longer pursue the company, but directors may still be personally liable in certain cases. |

| Intellectual property | Trademarks, patents, or copyrights owned by the company are transferred to the Crown unless action is taken beforehand. |

| Leased assets | Leases are typically terminated, and the lessor reclaims the asset. |

| Director/shareholder loans | Any unpaid loans owed to the company can still be recovered through legal processes. |

| Company shares in other firms | Shares owned by the company are transferred to the Crown. |

| Ongoing contracts | Contracts are voided, potentially causing losses for both parties. |

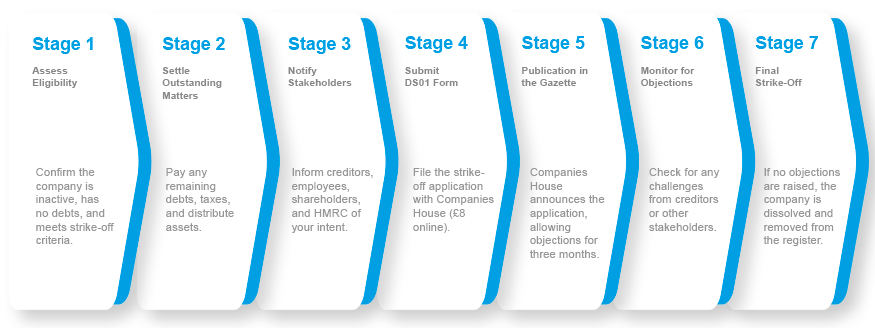

Company Strike Off: Summary Process

You can see here Stage 2 of our Company Strike Off process, early on in the process, is key when it comes to company assets.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Understanding ‘Bona Vacantia’

Bona vacantia refers to ownerless property that passes to the Crown when a company is dissolved. It’s important to grasp the rules governing Crown ownership and the process for reclaiming assets after a company strike-off.

Crown Property Rules

When a company is struck off the register, any remaining assets automatically become bona vacantia and transfer to the Crown. This includes tangible property like land, buildings, and equipment, as well as intangible assets such as intellectual property and bank accounts.

The Treasury Solicitor acts on behalf of the Crown to manage bona vacantia. They have the authority to sell or dispose of these assets as they see fit. It’s important to note that the Crown does not actively search for or manage these assets.

To avoid bona vacantia, you should transfer or deal with all company assets before dissolution. This ensures your property doesn’t unintentionally pass to the Crown.

Recovering Assets Post-Strike Off

If your company has been struck off with assets remaining, you may still have options to recover them. The primary method is through company restoration, which brings the dissolved company back into existence.

You’ll need to obtain consent and a bona vacantia waiver letter from the Treasury Solicitor. This effectively requests permission to restore your company and reclaim the assets. The process involves submitting an application to Companies House along with the necessary documentation.

Restoration can be complex and time-consuming. You may need to bring the company’s filings up to date and pay any outstanding fees or penalties. It’s often advisable to seek professional legal advice to navigate this process effectively.

Options for Distributing Assets

When a company is struck off, there are important decisions to make regarding the distribution of its remaining assets. The process typically involves settling with shareholders and addressing intellectual property rights.

Settling with Shareholders

You can transfer cash and assets to shareholders before the company’s dissolution. This approach allows for potential capital distribution treatment rather than income distribution. The total value of assets must remain under £25,000 for the company to be eligible for strike-off.

Directors may choose to transfer assets to themselves if they are also shareholders. This transfer should occur after submitting the strike-off application but before the actual dissolution. Document these transfers properly for tax purposes.

Consider selling valuable assets and distributing the proceeds to shareholders. This can simplify the process and ensure fair distribution based on shareholdings.

Handling Intellectual Property

Intellectual property (IP) requires special attention during asset distribution. You should identify all IP assets, including patents, trademarks, and copyrights.

Consider transferring IP rights to individual shareholders or a new entity. This preserves the value of these intangible assets and allows for potential future use or licensing opportunities.

Document the transfer of IP assets carefully. Ensure all necessary paperwork is completed to maintain legal ownership and rights. You may need to update registrations with relevant authorities to reflect the new ownership structure.

If IP assets have significant value, seek professional advice to determine the most tax-efficient method of distribution. This can help minimise potential capital gains implications for shareholders.

Free Consultation – advice@andersonbrookes.co.uk or call on 0800 1804 933 our freephone number (including from mobiles).

Need Clarity on Asset Distribution After Strike Off?

When a limited company is struck off, you may have questions about what happens to its assets. The process can vary depending on whether the strike off is voluntary or compulsory.

For voluntary strike offs, you must handle asset distribution before applying. This means selling or transferring company property and settling any debts. You cannot apply if the company has traded or disposed of assets in the past three months.

In compulsory strike offs, an Official Receiver or liquidator takes control. They sell the company’s assets to repay creditors. The priority order typically is:

- Taxes and secured loans

- Lower priority debts

- Shareholders and directors (if any funds remain)

You need to properly account for all assets before strike off. Failing to do so can lead to legal complications. Any assets left undistributed may become ‘bona vacantia’ – ownerless property that passes to the Crown.

If you’re unsure about handling assets, seek professional advice. An accountant or insolvency practitioner can guide you through the process. They’ll help ensure you comply with legal requirements and avoid potential pitfalls.

Remember, striking off a company with outstanding debts or assets can result in serious consequences. Always address these issues beforehand to protect yourself and fulfil your legal obligations.

Company Closure & Asset Protection Strategies

Your assets and how they are managed will depend on the best route you take for closing your business – whether that’s opting for a strike off or pursuing liquidation. Below is a quick overview of the key options available. However, we encourage you to speak to our qualified and experienced team, who can advise free of charge today.

0800 1804 933

Closure Options & Asset Implications

1. Strike Off

- Overview:

Striking off is an alternative procedure under the Companies Act, suitable for companies that have ceased trading and have no outstanding creditors. - Key Points:

- Only available to solvent companies.

- Any assets—not distributed before dissolution (including share capital and non-distributable reserves)—automatically become bona vacantia (passing to the Crown).

- If a company’s assets exceed £25,000, formal liquidation may be preferable for tax-efficient capital distribution.

2. Members’ Voluntary Liquidation (MVL)

- Overview:

An MVL is used for solvent companies with significant assets, allowing for an orderly distribution of proceeds as capital gains. - Advantages:

- Proceeds benefit from capital gains treatment rather than income tax rates.

- Potential eligibility for Business Asset Disposal Relief, which can lower the effective tax rate.

3. Creditors’ Voluntary Liquidation (CVL)

- Overview:

For insolvent companies, a CVL enables an insolvency practitioner to liquidate assets and distribute the proceeds fairly among creditors. See our CVL Costs. - Purpose:

- Prioritises creditors’ claims and ensures an orderly wind-up of the company’s affairs.

Pre-Closure Asset Protection Strategies

-

Conduct a Thorough Asset Audit: Identify all tangible (e.g., property, equipment, stock) and intangible assets (e.g., intellectual property, bank accounts) to understand your position fully.

-

Settle Outstanding Liabilities: Ensure that all debts, taxes, and financial obligations are cleared before initiating closure, as directors may be held personally liable if debts remain unsettled.

-

Document & Communicate:

- Maintain detailed records of asset transfers, valuations, and any liquidation procedures.

- Inform all relevant parties (HMRC, creditors, shareholders, employees) about your closure plans and ensure all statutory obligations are met.

Post-Closure Considerations

-

Restoration Process: If your company is struck off but you need to reclaim undistributed assets, restoration is possible within certain time limits. This typically involves obtaining a bona vacantia waiver and updating statutory filings.

-

Understanding Legal & Tax Implications: Each closure method carries distinct legal and tax consequences. Professional advice is essential to navigate these complexities effectively and ensure that the chosen route is the best fit for your circumstances.

Need Further Assistance?

If you’re considering closing your company or need tailored advice on safeguarding your assets, book a free consultation with our expert team today.

Tax Implications of Company Strike Off and Asset Distribution

What Happens to Company Assets Before Strike Off?

When a company is struck off, any remaining assets – including cash, property, stock, and intellectual property will automatically become the property of the Crown under bona vacantia rules. This means former directors and shareholders lose access to these assets unless they take action beforehand.

To prevent this, all company assets must be distributed or sold before applying for dissolution. If left too late, reclaiming them can be a complex and costly process. It’s not enough to simply stop trading – you need a structured plan to settle outstanding liabilities, move assets appropriately, and close financial accounts.

How Are Distributions Taxed?

Distributing assets before dissolution has tax implications, and getting it wrong can lead to unexpected tax bills. In the UK, how these distributions are taxed depends on their total value.

As noted above, if the total distributed amount is £25,000 or less, the money or assets received by shareholders are treated as capital gains rather than income. This is often more tax-efficient, especially for those who qualify for Business Asset Disposal Relief (BADR), which reduces the Capital Gains Tax rate to 10%. However, if the assets distributed exceed £25,000, the entire amount is taxed as income, meaning shareholders could face rates of 20%, 40%, or 45%, depending on their personal tax band.

For those with assets above this threshold, a Members’ Voluntary Liquidation (MVL) is often a better alternative. Unlike a simple strike-off, an MVL allows all distributions to be taxed as capital gains, which can significantly reduce the tax burden. Although an MVL involves the cost of appointing an insolvency practitioner, the potential savings in tax often make it worthwhile.

Final Tax Obligations Before Dissolution

Before applying for a strike-off, all tax matters must be resolved. A final Corporation Tax return must be submitted, and any outstanding balance must be paid. If the company was VAT-registered, a final VAT return needs to be filed before deregistering. Directors who were paid through PAYE must ensure that all National Insurance and payroll taxes are settled.

Failing to clear these obligations can cause delays and, in some cases, may lead to HMRC objecting to the dissolution. Directors should ensure that all financial accounts are in order before submitting a DS01 form to Companies House.

Impact of Strike Off on Creditors and Personal Liability Risks

What Happens to Company Debts After Strike Off?

A common misconception is that once a company is dissolved, any debts simply disappear. While it is true that creditors can no longer pursue the company in its dissolved state, they do have the right to restore it to recover their money.

Creditors – including suppliers, banks, and even HMRC – can apply to have the company reinstated on the register for up to six years after it has been struck off. If successful, the company is legally brought back to life, and creditors can continue their claims as if it had never been dissolved.

For this reason, directors should never assume that striking off a company is an easy way to escape liabilities. If there are outstanding debts, creditors will find ways to recover what they are owed. The best approach is to settle all outstanding obligations before applying for dissolution to avoid future complications.

Director’s Personal Liability – When Are You at Risk?

For most limited companies, directors are not personally liable for business debts. However, there are exceptions. If a director has signed a personal guarantee for a loan, lease, or supplier contract, they remain fully responsible for that debt, even after the company is dissolved. Creditors will pursue them directly, which can lead to legal action and financial strain.

A more serious risk comes from wrongful or fraudulent trading. If a company continues taking on debt when it is clearly unable to repay it, or if directors knowingly mislead creditors, they could be held personally liable for those debts. In extreme cases, this can lead to disqualification from serving as a director, personal bankruptcy, or even criminal prosecution.

HMRC also has strong powers to investigate tax-related issues. If a company is dissolved with unpaid VAT, Corporation Tax, or PAYE liabilities, HMRC can object to the strike-off or apply for company restoration. Directors who have mismanaged tax affairs—or who have deliberately avoided payments – may find themselves personally liable for these debts.

How to Manage Assets and Liabilities Before Strike Off

Distribute or Sell All Company Assets in Advance

Once a company is dissolved, any assets left undistributed automatically pass to the Crown, and retrieving them later can be complex and expensive. Directors should take proactive steps to transfer, sell, or distribute all company property before submitting a strike-off application.

For cash in the business account, it should either be withdrawn and distributed to shareholders or used to pay off outstanding debts. Physical assets, such as equipment or stock, can be sold or transferred to shareholders, but proper documentation should be kept to avoid tax complications.

Ensure All Debts and Financial Accounts Are Closed

Before applying for dissolution, directors must ensure that all business loans, leases, and supplier accounts are settled. Any outstanding debts must be repaid to prevent creditors from challenging the strike-off. It’s also important to close all company bank accounts and cancel any direct debits, as leaving money in the account after dissolution means it will be frozen and could become bona vacantia property.

If the company has significant debts it cannot afford to pay, striking it off is not an option. In these cases, a Creditors’ Voluntary Liquidation (CVL) is a more appropriate route, as it ensures an orderly wind-down of the business under the guidance of an insolvency practitioner.

Final Steps to Protect Directors and Shareholders

Directors should keep detailed records of all asset transfers, final transactions, and communications with creditors. This is especially important in case of any future disputes or claims against the dissolved company.

If the business has substantial assets or unresolved liabilities, seeking professional advice from an insolvency specialist can be invaluable. They can provide guidance on tax efficiency, asset distribution, and managing potential risks before submitting a dissolution request.

Frequently Asked Questions

Company dissolution raises important questions about asset ownership, director responsibilities, and legal implications. Understanding these key issues will help business owners and directors during the strike-off process.

Who retains ownership of the assets when a company is dissolved?

When a company is dissolved, any remaining assets become “bona vacantia” – ownerless property that passes to the Crown. The Treasury Solicitor’s Department manages these assets. Former directors or shareholders have no legal claim to the property after dissolution.

What are the implications for a director after their company is dissolved?

Directors lose their official status once a company is dissolved. You may face personal liability for any company debts or obligations that weren’t properly settled. Continuing to trade or act on behalf of a dissolved company is illegal and can lead to fines or prosecution.

How does a company transfer property before being dissolved?

Before dissolution, you must transfer or dispose of all company assets. This includes selling property, closing bank accounts, and transferring intellectual property rights. Ensure all transactions are properly documented and completed before applying for strike-off.

What should be done with company assets prior to closing a business in the UK?

Sell or distribute assets to shareholders before closing. Pay off all debts and creditors. Close bank accounts and cancel any ongoing contracts or subscriptions. Transfer or cancel any leases, licenses, or intellectual property rights. Keep detailed records of all asset disposals.

What are the legal consequences for a company and its assets following a strike off?

The company ceases to exist legally. Assets become Crown property. Creditors may apply to restore the company to pursue debts. Directors can face personal liability for unresolved obligations. Continuing to trade as a struck-off company is a criminal offence.

How are a company’s bank accounts handled upon strike-off proceedings?

You must close all company bank accounts before applying for strike-off. Inform your bank of the impending dissolution. Transfer any remaining funds to shareholders or use them to settle outstanding debts. Provide the bank with formal notification once the strike-off is complete.

You may also be interested in:

Striking Off Advice: Google Reviews

&